New analysis by AJ Bell shows that taking a pension tax-free cash earlier than planned could result in losing a significant amount of money, compared with leaving it invested to be taken at a later date.

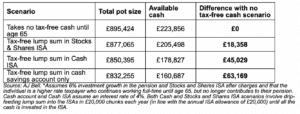

The platform said that someone with a pension pot valued at £500,000 at age 55, who takes their full 25% tax-free cash from their pension and moves it into a cash savings account paying 4%, could lose out on £63,169 in tax-free cash by age 65, compared with leaving the amount invested in their pension.

That same person drip-feeding their lump sum into a Cash ISA or investing it via a Stocks and Shares ISA would be able to mitigate the impact by using an ISA’s tax shelter status, but could still be worse off by £45,029 and £18,358 respectively*.

Rumours surrounding pension tax incentives, including a potential reduction in pension tax-free cash, have emerged as possible levers the chancellor could pull to boost public finances.

AJ Bell emphasised that these are just rumours and there are multiple reasons why the chancellor may think twice before opting to go down this route, not least the potential uproar from public sector pension savers.

And that pension savers should ensure any decision to take their tax-free cash is aligned with their long-term strategy for retirement, rather than a knee-jerk reaction to speculation.

Difference in lump sum available by age 65

Tom Selby, director of public policy at AJ Bell, said one of the most pernicious of the current rumours ahead of the Budget which could influence behaviour and potentially cause damage to the retirement prospects of was that around pension tax-free cash.

“The same rumours emerge every year almost in lockstep with the weeks leading up to the Budget, whether the incumbent government of the time decides to hold one or more major fiscal events.

“This has a direct impact on pension savers who have saved diligently throughout their careers under the proviso that they could access a tax-free lump sum of up to 25% of their pot, often wreaking havoc with their longer-term retirement plans. But the potential for a medium-term hit worth tens of thousands of pounds highlights that the decision to access tax-free lump sum is not one that should be taken lightly under any circumstances, whether there are rumours swirling or otherwise.

Referring to the analysis undertaken by the platform, Selby said: “This chasm in the wealth prospects of those who continue to nurture their pension fund versus those who decide to access their pension at an earlier stage is partly explained by the assumption that they stick their entire tax-free lump sum into a cash account paying less interest over time than leaving it invested.

“But even someone drip-feeding their lump sum into a Cash ISA or investing it via a Stocks and Shares ISA could still be worse off by around £45,000 and £18,000 respectively, despite benefitting from the ISA’s tax-free status.

“On top of this, assuming no change to existing rules, anyone who takes their full 25% allowance out of their pension will likely end up subjecting at least a portion of it to tax and may also push themselves into a higher tax bracket to boot, resulting in a higher tax bill.

“For example, if the money is in a cash savings account, then they may have to pay tax on the interest (along with the interest on other taxable cash savings accounts) if it exceeds the personal savings allowance – up to £1,000 tax free for basic rate taxpayers and £500 for higher rate taxpayers.

“A recent FOI obtained from HMRC by AJ Bell showed that pensioners make up almost half (44%) of all taxpayers hit by tax on their savings interest. Anyone considering taking their tax-free cash early could see themselves fall into that group and leave their money exposed to savings tax, as well as any other taxes.

If the money is invested in the stock market outside of a pension, this may incur a capital gains or dividend tax bill, even if the client was intending to move it into a tax shelter such as an ISA, he added. “This is because a pension tax-free lump sum could easily take a number of deposits over several years to drip-feed into the account within the ISA’s annual allowance of £20,000, and therefore leave at least a portion of it exposed to tax while that process is ongoing.”

Selby emphasised that for clients having a clear plan for the money if taken, such as putting it towards paying off the last of a mortgage or other debts, then leaving money in the pension until it is needed would still often be the best course of action.