IBOSS Investment Director Chris Metcalfe reviews 2020 and looks ahead to beginning of 2021

One of the most used words to describe the last 12 months has been “unprecedented”. Against the backdrop of the global Coronavirus pandemic, the events of 2020 have affected markets like no other year we’ve seen before.

With this in mind, rather than a straight forward review of the year, we thought it would be good to look back at the key periods throughout 2020 as they actually unfolded and what we know heading into 2021…

Global Equity Performance (Year to Date < 04.12.2020) fig 1

At each one of the changes in markets or style direction shown in the year to date chart (fig 1), it would have been impossible to say with conviction what the next period would bring and who would be the winners and losers.

Early January – Business as usual

2020 risk assets, particularly equity markets, have been clearly demarcated and the opening two weeks of January started where 2019 left off, in a firmly bullish mood.

Mid-January > End of February – This is not normal

During this period, the world started seeing early signs that Covid-19 was, potentially, a bigger deal than many at first thought. However, for almost a month, markets managed to hold on. It seems incredible now, but it wasn’t until March 11 that the WHO declared Covid-19 a pandemic. The world was suddenly awash with armchair epidemiologists and conspiracy theories were all over social media. The daily case numbers, however unreliable, were sufficiently alarming to have investors running for cover.

22nd February > 23rd March – Blind Panic

The reality was dawning that the outcome of the pandemic was mostly unknown and the blind panic set in. China outperformed on a relative basis as it was seen containing the spread of the virus, and some WFH (working from home) tech stocks seamlessly morphed from growth to defensive plays. Value stocks hit new lows led by the UK and Europe, and temporarily the futures oil contract went negative, which is even less intuitive than Greek bond yields doing so, but this is the world we now live in. Any portfolios which were overweight dividend stocks were particularly hard hit and once again we learned that diversification is valuable because we cannot predict the future.

24th March > 30th September – Someone, please help stop this!

The question became for all investors and traders; could the central banks, in collaboration with their governments, promise enough stimulus to calm the markets?

The answer we now know was an emphatic yes! The five months up to the end of August saw one of the fastest market recoveries ever led by tech and taking much of the US markets with it. Europe and especially the UK, both correctly seen in aggregate as Value plays continued to struggle.

1st September > 31st October – US fiscal stimulus replaces China trade talks, as the new market narrative

Arguments about another fiscal stimulus package in the US and escalating virus numbers caused the markets to pause in September. The US election was also looming, and questions were being raised about the valuations of the seemingly impregnable WFH tech stocks, as the MSCI World/Information Technology shed nearly 10% in September and October. China and Asia held up well, but yet again it was the UK that just couldn’t catch a break and was once more the worst-performing developed market.

1st November > Early December – The Great Rotation?

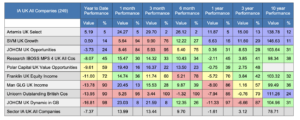

So, we come to November, and this remarkable year in the equity markets takes yet another dramatic twist. News breaks about a vaccine with high efficacy and is quickly followed by several others. The light at the end of the proverbial tunnel finally seems it might be within reach and all of a sudden value is back! We have now had five weeks of market gains for Europe and spearheaded by the previously seemingly uninvestable UK. At the time of writing it is expected the vaccine will start to be rolled out in the UK as soon as this week. It’s obviously going to take time, but the speed of the market’s rotation into Value stocks is unprecedented. The table (fig 2) shows our UK holdings and highlights the extraordinary turnaround. This indicates that it is not just necessary to be diversified in geographies but also fund style.

What do we know going into 2021?

Despite the least gracious performance from an outgoing president in living memory, it will nevertheless be the Democrat Joe Biden who will take up residency in the Whitehouse next year. We expect lavish spending plans where he can obtain the funding, but it will be a difficult job if the Republicans still control the Senate.

We can expect super accommodative monetary policy globally, and we expect an unofficial currency war to run throughout the coming years. If the dollar continues to weaken, this will be positive for emerging markets.

We do expect the value renaissance to persist through 2021 and this will help both the UK and Europe despite whatever is happening with issues such as Brexit and the EU’s much-hyped recovery fund. We see the most significant risk to markets as a worsening of the pandemic, and for that reason, we expect January and February to be volatile. Thanksgiving and Christmas will highly likely create a spike in case numbers but by Q2 of 2021, the effects of this period should be behind us and the vaccine rollout well underway.

The benefits of diversifying within a sector

As the table (fig 2) highlights, funds moved about on a relative basis exceptionally quickly. It is hard to see now in the table, but it was Unicorn Outstanding British Companies, SVM UK Growth and JOHCM UK Opportunities which gave us the best protection in the pandemic drawdown.

UK Equity Fund performance Ranked within Sector fig 2

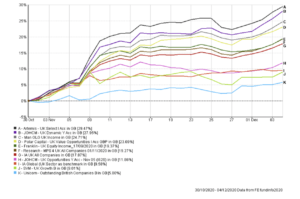

Since the beginning of November, it has been our Value and Income funds which have been leading the way (fig 3). We might have mentioned this before, but we strongly feel that the use of multiple funds in a sector can offer protection from sudden changes in style whilst still capturing significant upside over the longer term.

UK Equity Fund performance (01.11.2020 < 04.12.2020) fig 3

This communication is designed for Professional Financial Advisers only and is not approved for direct marketing with individual clients.

Past Performance is no guarantee of future performance. The value of an investment and the income from it can fall as well as rise and investors may get back less than they invested. Risk factors should be taken into account and understood including (but not limited to) currency movements, market risk, liquidity risk, concentration risk, lack of certainty risk, inflation risk, performance risk, local market risk and credit risk.

Data is provided by Financial Express (FE). Care has been taken to ensure that the information is correct but FE neither warrants, neither represents nor guarantees the contents of the information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein. Please note FE data should only be given to retail clients if the IFA firm has the relevant licence with FE.