Wealth management must innovate to protect medium and long-term returns, says Yan Swiderski, Co-Founder of the Global Returns Project

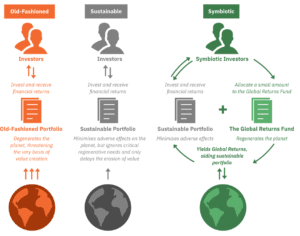

The old-fashioned approach to wealth management is broken. In the age of the Climate Crisis, neither investors nor advisers can afford to focus entirely on financial returns without considering their impact on the planet. Growing awareness of the need to innovate has made sustainable investing increasingly popular. But on its own, sustainable investing just isn’t enough to protect clients’ medium and long-term returns. It’s time for a true breakthrough.

Symbiotic Wealth Management means pairing sustainable investments with a small allocation to climate not-for-profits. While not-for-profits don’t generate wealth, they do regenerate the planet beyond the capacity of sustainable investing alone. They therefore protect wealth and offer a critical complement to any sustainable investment portfolio. Symbiotic Wealth Management is the future of successful investing.

The rise of sustainable investing

The actual and projected costs of climate change already render traditional investment strategies untenable. But without dramatic action to tackle climate change, scientists put global warming on track to reach 5°C by 2100. One estimate concludes that at just 3.7°C, global economic damages could total $551 trillion: more than all existing wealth today.

Wealth management must innovate to protect medium and long-term returns. Many investors and advisers understand this reality and have embraced sustainable investing as a result.

By some estimates, global sustainable investing assets already total $35.3 trillion. This surge in popularity has prompted a fundamental shift in investor and adviser priorities. In a December Schroders survey, 75% of advisers described an increase in sustainable investment enquiries from their clients.

Sustainable investing’s shortcomings

As a response to the Climate Crisis, however, sustainable investing has two serious shortcomings. First, recent studies have had difficulty drawing a connection between sustainable funds and positive environmental effects. An assessment of over 700 equity funds marketed using ESG and climate-related key words found that 71% scored negatively in terms of portfolio Paris Agreement alignment. A report from Bloomberg last December also illustrates how ESG labels can so often prove inaccurate; Bloomberg found that the largest ESG rating company, MSCI, does not attempt to measure a company’s environmental effects at all.

Sustainable investing’s second shortcoming might be even more significant. Even an effective, transparent approach to ESG would fail to implement many critical climate solutions. As a market initiative, sustainable investing cannot fund non-market solutions. These include suing polluters, protecting rainforests and defending carbon-sequestering whale populations. They also include systemic solutions such as advocacy and policy work. Without these interventions, we can neither mitigate climate change nor protect medium and long-term investment returns.

The power of not-for-profits

This is where Symbiotic Wealth Management comes in. To adopt Symbiotic Wealth Management, an investor allocates a small amount to not-for-profit organisations tackling climate change alongside their other investments. Not-for-profits tackle the fundamental problems that sustainable investing cannot address. While these organisations do not deliver financial returns, they do deliver ‘Global Returns’ – that’s our term for the enhancement and protection of the biosphere. These returns are real and identifiable. And all our investments are less risky when we enhance and protect the biosphere.

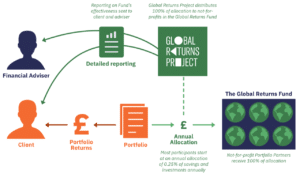

How do we make Symbiotic Wealth Management normal and easy for everyone? It starts with applying a rigorous investment mindset to not-for-profit initiatives. At the Global Returns Project, we have assembled a portfolio of powerful climate not-for-profits which we call the Global Returns Fund. We select each not-for-profit using our own methodology. Every six months, we use that methodology to review the portfolio again, drawing on our Technical Advisory Board’s climate expertise.

Our methodology assesses not-for-profits by their impact, scalability, networks and co-benefits. It seeks a diversity of solutions, activities, beneficiaries and geographies. It also evaluates the total range of activities our portfolio carries out – it reports these activities as a proportion of all possible areas of not-for-profit climate intervention.

How does it work?

Allocating to the Global Returns Fund is an easy way for clients to adopt Symbiotic Wealth Management. Most participants start at an annual allocation of 0.25% of savings and investments, but the amount is entirely up to them. As a UK registered charity, the Global Returns Project does not charge any fees at all to advisers or their clients. 100% of a client’s allocation goes to the not-for-profits in the Global Returns Fund. Any allocations made by UK taxpayers are eligible for Gift Aid and highly tax efficient.

In the face of the Climate Crisis, regenerating the planet is absolutely the right thing to do. But it’s also financially logical for any investor hoping for consistent medium and long-term returns. By regenerating the planet beyond the capacity of sustainable investing alone, climate not-for-profits provide a critical complement to any asset allocation strategy. Forward-thinking financial advice firms can stay ahead of the curve by introducing clients to Symbiotic Wealth Management.