Should the Lifetime Allowance charge be avoided at all costs or are there circumstances where it is worth the client paying the charge? Dave Downie, technical manager, Standard Life considers the options

Many clients will have seen their retirement savings dented by falling markets on the back of the pandemic. When combined with the CPI increase to the Lifetime Allowance (LTA), this could be the trigger for some clients to boost their retirement savings by increasing or recommencing pension contributions.

However, the concern for some will be a potential LTA charge when the benefits are taken should markets rebound to pre-Covid19 levels. However, the possibility of an LTA charge is not necessarily a reason to give up on future pension funding.

The tax charge may be a price worth paying if the net returns are greater than what can be achieved by diverting saving elsewhere.

Ultimately it comes down personal circumstances. Ceasing funding may mean giving up on contributions made by the employer. Equally recommencing contributions could lead to a loss of valuable LTA protection.

Fixed Protection

Anyone with fixed protection will lose this if there are any new payments into their pension. This includes those who re-join their employer’s auto-enrolment scheme, even if the employer pays all the contribution, or if they’re enrolled into a new employer’s scheme. With the LTA currently at £1,073,100 for 2020/21, this could mean losing up to £176,900 of LTA protection.

That could mean a trade-off between an increased LTA and the loss of employer funding. The period until retirement and how close their pension funds are to the standard LTA are critical factors in determining the best outcome for the client.

The loss of employer funding

Many employers offer matching contributions. Stopping funding may mean their employer stops contributing too.

Employer pension contributions are essentially ‘free money’. Even if they suffer an LTA charge of 55% on their entire future employer funding, they’re still receiving 45% of something they would otherwise miss out on. It may therefore make financial sense for most to continue their own funding to retain the funding from their employer, despite the LTA charge.

Alternative employer remuneration package

Some employers may offer additional salary instead of making pension contributions for those key employees caught by the LTA. This more likely in the private sector than the public sector.

But additional salary will mean there’s tax and NI to pay. The employer may only be willing to pay an amount equal to the same net cost as the pension contribution (i.e. after employers NI liability).

For example, a higher rate tax paying employee receives an annual employer pension contribution of £40,000. After deduction of employer NI at 13.8%, that would equate to additional salary of £35,149. The employee then has income tax and NI to pay on the additional salary, so the amount they receive would be £20,386.

But if the additional salary is to be used to save for retirement they will need to find an alternative home for these savings and none of the other savings choices offer the same tax advantages as a pension.

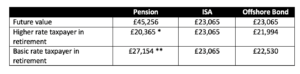

The table below shows what the client might get back by investing the net pay of £20,386 over five years into another investment wrapper with the same gross roll up and achieving a 2.5% real rate of return. This is for illustrative purposes as the net pay is greater than the current ISA allowance, but this could still be achieved by using a spouse’s allowance.

* After LTA charge of 25% + 40% income tax on balance if taken as income

** After LTA charge of 25% + 20% income tax on balance if taken as income

The anticipated tax position of the client when funds are withdrawn makes a big difference to the outcome. If pension income would all be taxed at higher rate, it’s clearly better to take the extra salary and invest it elsewhere. But if income can be extracted from the pension at basic rate, then it swings more in favour of funding beyond the LTA even with the 25% tax charge.

Making personal contributions that result in an LTA charge

But what about making personal contributions that will exceed the LTA without the added bonus of employer matching? Again, it comes down to what clients will get back after all taxes have been deducted.

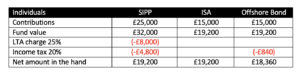

If income in retirement can be kept at basic rate then personal contributions receiving 40% tax relief, even after the LTA charge, will achieve exactly the same return as an ISA.

The table below compares what the client might get back in their hand assuming a real rate of return of 2.5% over 10 years for the same net cost of £15,000.

An additional consideration is that the unlike the pension the ISA and offshore bond will both form part of the estate on death.

Summary

It’s only natural to want to avoid tax charges. But the alternatives will generally have their own tax consequences and these need to be factored to determine the best outcome for the client. And this could still be to carry on funding their pension.