For our latest parameters survey we asked paraplanners for their views on what changes we might see for IHT and ISAs in the imminent 2024 Spring Budget. Fiona Bond reports on the results.

With the Spring Budget on 6 March, there has been growing speculation about what the Chancellor could pull out of his bag to win votes ahead of a General Election, including a big shake up of taxes and the potential abolition of inheritance tax.

The fiscal plan comes at a difficult time for the Government, with recent figures confirming the UK economy had entered recession in the final quarter of 2023 and confidence in the Conservative Party at an all-time low, so Jeremy Hunt is likely to be keen to offer something to voters. While nothing is certain until the day, Professional Paraplanner asked paraplanners for their predictions.

Inheritance tax changes

The cut in inheritance tax has been speculated on as a potential change. While there had been a growing expectation that the Chancellor would use last year’s Autumn Statement to make an announcement, to date nothing has materialised.

However, a cut to inheritance tax has polarised commentators, with some believing it to be a people-pleaser, while others have described it as a move that would favour the better-off at a time when the country is struggling with a cost-of-living crisis.

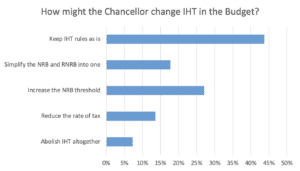

Nearly half (44%) of paraplanners surveyed believe the Chancellor will choose to keep IHT rules as they are, particularly with the tax continuing to prove a generous source of income for the government.

One paraplanner said: “With so much speculation over the IHT rules, and the levels of tax that IHT brings in, I don’t believe that the government will want to make any drastic changes to the current IHT regime, not until after the general election. If anything was to change, it is likely that Labour would call them unfunded tax cuts or accuse them of taxing the British public more. Until the government is able to move forward on a new majority government, it is unlikely that they will seek to change any further tax legislations.”

Another paraplanner commented: “There is always speculation about IHT and how rules might change. But for as long as it continues to be a nice earner for the Chancellor, I don’t see a lot changing.”

A further response suggested that changes to IHT would draw criticism from the Labour Party.

They said: “It’s particularly sensitive especially when money is tight, an easy target for the opposition – ‘giving something to the rich when there are plenty of the needy.’”

However, more than a quarter (27%) believe the Chancellor may increase the Nil Rate Band threshold to appease voters. The current NRB of £325,000 was set in 2017 and has since been frozen until 2028 as part of the Government’s wide-sweeping freeze on tax thresholds. However, the failure to increase the threshold has met with criticism, with commentators pointing out that had the NRB tracked inflation, it would be close to half a million.

One paraplanner said: “Government gets too much income from IHT to do away with it altogether but increasing the NRB threshold will be a vote winner.”

In addition, nearly a fifth (18%) believe Jeremy Hunt will look to simplify the NRB and the Resident Nil Rate Band by merging the two and 14% expect him to reduce the rate of tax. The rapid growth of house prices has meant that many people who did not expect to be liable for IHT now fall into the scope. Recent IHT receipts found the government raked in £6.3 billion between April 2023 and January 2024, up £0.4 billion than the same period last year, leaving the government on track to rake in record-busting amounts.

One paraplanner commented: “I feel he would simplify the bands as reducing or abolishing the tax would not go down well politically.”

Another said: “Expect nothing drastic but he may increase allowance and certainly merge existing allowances, removing the conditions with existing RNRB.”

One respondent told Professional Paraplanner: “It is a good source of tax so I do not think it will be abolished but a reduction in the rate would keep the tax stream.”

However, a small minority (7%) expect the Chancellor to go one step further and abolish IHT altogether.

“The current Chancellor, while seeking to gain a reputation for fiscal prudence, is also keenly aware that unless something changes the electoral calculus he will be out of a job later this year. By abolishing IHT he seeks to make political gain for his party,” one explained.

Tackling the ISA system

ISAs have come under the spotlight of late, with investment provider AJ Bell calling on the government to simplify the current ISA regime to encourage more investors.

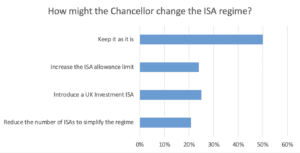

Our survey found a fifth (21%) of paraplanners expect the Chancellor to reduce the number of ISAs to simplify the system.

One told Professional Paraplanner: “I think the talk about simplifying the number of different ISAs makes sense. Simplicity seems to be key to much of the talk coming out of Parliament about saving.”

Another said: “He may amalgamate cash and stocks & shares ISAs into one, making it easier to see what clients are seeing.”

A slightly higher number of paraplanners (24%) believe the Chancellor will increase the £20,000 a year ISA allowance limit. The current limit has been static since the 2017/18 tax year but with dividend tax and Capital Gains Tax allowances continuing to shrink, many argue that increasing the annual ISA allowance would offer a much-needed tax break for investors.

One paraplanner told Professional Paraplanner: “I believe the ISA allowance limit will rise, not for any practical reason beyond electoral expediency.”

Another said: “If anything was changed, I feel the ISA allowance may increase as this has been £20,000 for many years now.”

Meanwhile, a quarter (25%) of paraplanners expect the government to introduce a UK investment ISA. The Chancellor has hinted at plans to launch a ‘British ISA’ investing in UK company shares in an effort to boost the country’s stock market.

“I can see a UK investment ISA being appealing to the government in order to encourage investments into UK industry and boost the economy,” one paraplanner said. “An increase to the ISA allowance would be nice, but it is possible that this could also be used against the government by favouring the rich who can afford to maximise their ISAs each year.”

However, half of paraplanners (50%) believe that despite fervent speculation, the Chancellor will choose to keep the ISA regime as it is, noting that additional ISAs would add to the complexity of an-already complex system.

“There has been a lot of talk about this, but it will have little traction and probably end up on the great product scrapheap like stakeholder pensions,” said one paraplanner.

Another added: “He will not be creating any additional ISAs nor increasing the limits as this is against his objective of reducing the deficit.”