While structured products are categorised as alternative investments, modern portfolio theory shows they can improve the risk/reward ratio of portfolios making them more efficient, says Ian Lowes, managing director of Lowes Financial Management

Alternative – ‘something that is different from the norm’. I fear that for many financial advisers today, this means ‘off platform’. Of course, it’s safer to stick with the crowd, the tried and tested, the safe. But independent financial advisers have a responsibility to be looking at the whole investment universe, and not be married to a platform, or pre-conceived portfolio ideas. Many alternatives are not safe. And if you’ve been entrusted with someone else’s money, you better be playing safe. So, be skeptical of alternatives – it’s safer that way. But don’t be closed minded.

Today’s improved qualification thresholds for advisers should make them more aware of the wider market and alternatives. Yet for the CII at least, the textbooks and exam syllabus are void of any real detail on alternatives. So qualified advisers ultimately learn enough to know that they don’t know and they either take time to learn and understand or stay away. The result is that many alternatives, remain just that, alternative, and pretty much out of sight of most advisers, independent and otherwise. And as such, out of sight of their clients.

But occasionally, an alternative becomes mainstream. And the market plays catch up.

Structured products don’t fall into conventional asset categories and as such, used to be considered ‘alternative’. To many they still are. Often just a complete enigma. But in my opinion, nothing manages risk and contributes to portfolio returns better, than a satellite portfolio of autocalls.

Benefits of autocalls

And it isn’t rocket science. Autocalls are ultimately contracts issued by banks, through a third-party issuer, with all the protections of a separate custodian and administrator. They are typically stock market linked investments that will mature, with a decent return on the second, or subsequent anniversary provided the stock market is up. How many years will you have to wait? As with any equity investment, you simply don’t know – hopefully only a few – ideally a few more as the returns compound – just make sure the maximum term is long enough to give you time.

Of course, there is risk. But like the returns, the risks are clearly defined. First, investors are lending money to the bank – if it goes bust it could take a long time to get, potentially very little back. Highly unlikely but a risk all the same. Then there’s the risk that the stock market never rises – at least not to the extent its higher on a maturity anniversary – and this happens every year, including the last. If the stock market is below the protection barrier – say a fall of more than 40% over the multi-year term, then an equivalent loss will arise. Again, highly unlikely with a mainstream stock market index and long term, but possible.

1,000 autocalls later

The world’s first autocall was offered in the UK IFA market in 2003, and since then over 1,000 FTSE 100 linked, capital at risk autocalls have matured for UK IFAs’ clients. But despite the numbers, these are still alternative investments to many. Of these 1,000 maturities, none made a loss and only eight failed to mature with a gain. So that’s over 99% success for this “alternative investment”. As to the returns, the collective average annualised return of these matured alternatives was over 8% per annum, with the lowest positive maturity returning over 4.8% per annum. Imagine that, an alternative investment with a track record like that – more than 99% returning an average of 8% per annum!

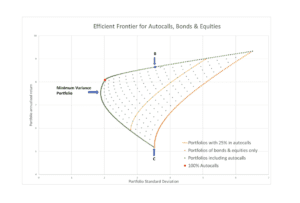

Any investment with a record like that could demonstrably prove to lower risk and contribute well to portfolio returns. Given the numbers, it shouldn’t be necessary to prove the point, but if we look at the returns, produced by all these maturities and compare them with the returns of a FTSE 100 tracker and the Sterling Corporate Bond sector average over the same durations, testing a wide range of different, weighted portfolios of the three assets, we get the accompanying chart.

The Minimum Variance Portfolio for this data is one that represents 81% allocation to autocalls and 19% to bonds. The chart also highlights the position of the autocall portfolios that include 25% in autocalls. All portfolios to the right of the yellow line have lower than 25% allocation to autocalls. The inclusion of autocalls in the portfolios leads to the Efficient Frontier moving left, indicating lower risk for the same return.

Point ‘B’ is 55% allocated to structured products and the balance to equities. This portfolio offers significantly greater return for the same risk as a portfolio consisting of 100% bonds shown at ‘C’ which is the least efficient portfolio.

This, admittedly crude application of Modern Portfolio Theory shows that the inclusion of autocalls in a portfolio improves the risk/reward ratio of the portfolios making them more efficient. Whilst the results are somewhat extreme, the conclusion of the analysis is that portfolios are improved by the inclusion of autocalls. Which is surely what anyone would conclude from the numbers in the first instance. Of course, past performance is not a guide to the future but for that reason alone, autocalls make for an appropriate inclusion in portfolios.

So, what makes an alternative investment, alternative? Whilst I would say that if it’s outside of the regulators remit, such as wine and collectibles, then it truly is alternative and probably much safer for advisers to steer clear of. But if it’s an accessible, regulated investment that you consider to be alternative, its possibly just a case of something you know you don’t know about, yet.

Capital at risk.

This article was first published in the May 2021 issue of Professional Paraplanner.