The number of savers flexibly accessing their pensions spiked in the second quarter as the cost of living crisis took hold, prompting pension specialists to warn that savers could be left without sufficient provisions later in life.

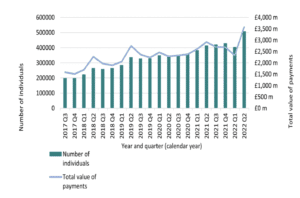

According to the latest flexible pensions data from HM Revenue & Customs, the amount of money withdrawn between 1 April and 30 June jumped 23% quarter-on-quarter to £3.6 billion.

A total of 508,000 individuals withdrew money from their pensions, with an average withdrawal of £7,000 – up from £5,800 in the previous quarter.

Stephen Lowe, group communications director at Just Group, said that while the number and value of flexible payments was expected to rise in line with the previous trend, the spike in value raised concerns.

Lowe said: “We would expect to see the number and value of flexible payments from pensions increase as more people reach the age when they access their pensions. What does give us cause for concern is the 23% spike in the value of payments withdrawn compared to the same quarter of 2021.

“The second quarter of the year typically sees the highest volume of money withdrawn from pensions, but we have never seen more than £3 billion accessed, let alone more than £3.5 billion. It suggests that the cost-of-living crisis could have started to impact people’s behaviours when accessing their pensions.”

Lowe said the main worry is that people may be taking a chunk out of their pension to tide them through the cost of living crisis unaware of the long-term consequences and the Money Purchase Annual Allowance, which caps future contributions at £4,000 per year rather than the normal £40,000.

Lowe added: “They may have plans to increase their savings in the future to make up for what they’ve withdrawn, but by triggering the MPAA they significantly limit the tax relief future pension savings will attract – making that saving much harder work.

“We really don’t know how many people understand the longer-term consequences of taking their first flexible payment. So there’s one simple piece of advice for everybody considering dipping into their pension pot – either seek professional, regulated advice or take advantage of the free, independent and impartial pensions guidance from government-backed Pension Wise.”

Jon Greer, head of retirement policy at Quilter, warned that the jump in withdrawals is “likely just the start”, with more people needing to access their pension to pay for spiralling bills.

Greer said: “Although over the last few years the number of flexible withdrawals from pensions has risen this represents a significant spike. During the pandemic we didn’t see such big increases as the government support schemes did their job and prevented a mass exodus of savings. However, we are now facing a very different beast as energy bills and food costs are set to soar along with mortgage payments and pensioners may well feel that they need more each month to get by.

Greer called for the Government to relax the MPAA rules for the current tax year to avoid people from saving further once their finances are in better shape.

Greer said: “According to the ABI, someone in their 50s on average earnings would only have to pay an extra £151 a month into their pension, above the minimum required, to exceed the MPAA. Paying more than £4,000 a year would mean having tax relief clawed back. This effectively punishes people trying to do the right thing and severely limits their ability to save for retirement in the future. It’s high time this inflexible rule was scrapped in favour of a general anti-abuse approach similar to that taken for existing pension recycling rules, which gets to the crux of HM Treasury’s concerns.”

Andrew Tully, technical director at Canada Life, commented: “It is important the industry – Government, providers and advisers – help make sure people make the best decisions – dripping funds out gradually rather than all at once can save tax. And if taxable income is taken then the money purchase annual allowance limits future savings considerably to £4,000 a year – so taking some tax-free cash only may be the best option for some, especially if you plan to continue working and contributing.

“There also needs to be an awareness that if many people withdraw much of their pension now then it won’t be able to provide retirement income for all of their retirement, so there may be more pressure on state pensions and other benefits in later life. Using the home as an asset may increase in later life as a result.”

Chart: The reported value of taxable flexibly accessed payments and number of individuals accessing these payments by quarter from Q3 of 2017 to Q2 of 2022.