Jackie Lockie, head of Financial Planning at CISI, looks at the potential impact of advancing technology on vulnerable clients

As I’m sure you know, the FCA closed its most recent consultation paper 65 GC19/3 on vulnerable clients on 4 October 2019. That paper talked much more broadly than its previous communications about the potential markers for consideration when identifying and supporting vulnerable clients.

As paraplanners, you will play an important role in both identifying and supporting vulnerable clients in your businesses. The onus is on all of us to play our part.

Whilst in Zurich recently, I participated in three days of meetings of the global financial planning professional bodies and I talked to them about the issues that we are facing, not only in the UK but also across Europe. We shared ideas and thoughts on what happens in other countries. What was interesting was the complete acceptance and recognition that globally we all need to do more to identify and support vulnerable clients. Across 26 different cultures the same concept of vulnerability exists and is recognised. In some countries the government takes responsibility. In others it is the regulator. In Europe, MiFID II (Section 40) talks about identification and adaptation too. Interestingly though, here in the UK we do seem to be talking in much broader terms.

One thing that jumped out at me during our discussions was an innocuous question from one of the other delegates, “How does fintech impact this?” It got me thinking.

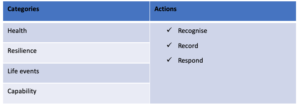

Here is the table of information given in the consultation paper. You’ll see that age isn’t specifically listed but much broader groups of people, e.g. under 24 and over 65, are referred to in the FCA consultation paper.

As financial planning advances and fintech becomes more commonplace, where can these advancements hinder our consideration of vulnerable clients? If we look at each of these categories, where does fintech impact?

Health? Yes, if a client is in pain or has a medical condition that might make it hard for them to read from a screen or your normal font size in documents.

Resilience? Other than our ‘silver surfers’, those over 50s who are very tech savvy, there are millions of people who do not have easy access to the internet. Of those who do and even those who might have a tablet device, many will not be confident in using that technology on a regular basis. The impact might be that they would not want to conduct their financial affairs online.

Life events? If a client has an accident or finds themselves in a completely different situation, they may not be familiar or confident in accessing fintech to conduct their financial affairs. This might be either temporary or permanent. It would also encompass, for example, receiving a sudden cash windfall, such as from an inheritance or business sale.

Capability? I heard that in one emerging economy, the government has reduced the pass mark for maths examinations in a reaction to a whole generation of tech savvy children seemingly being unable to assimilate technical information. This will have long term ramifications to the world we inhabit.

Whilst various countries around the world have differing situations, we should consider the impact of clients and their children being financial literate and astute enough to conduct their financial planning using some form of fintech moving forward. Did you know, for example that in one Asian country, almost no one has a laptop! Everyone has a mobile phone and nothing else. Some of those who have a phone aren’t confident using it. Add in financial literacy issues and we could have major issues popping up in the future. There certainly do seem to be many individuals around the world who are using technology but also many who do not understand what these fintech solutions are really doing for them.

So in answer to that innocuous question, fintech impacts everywhere.