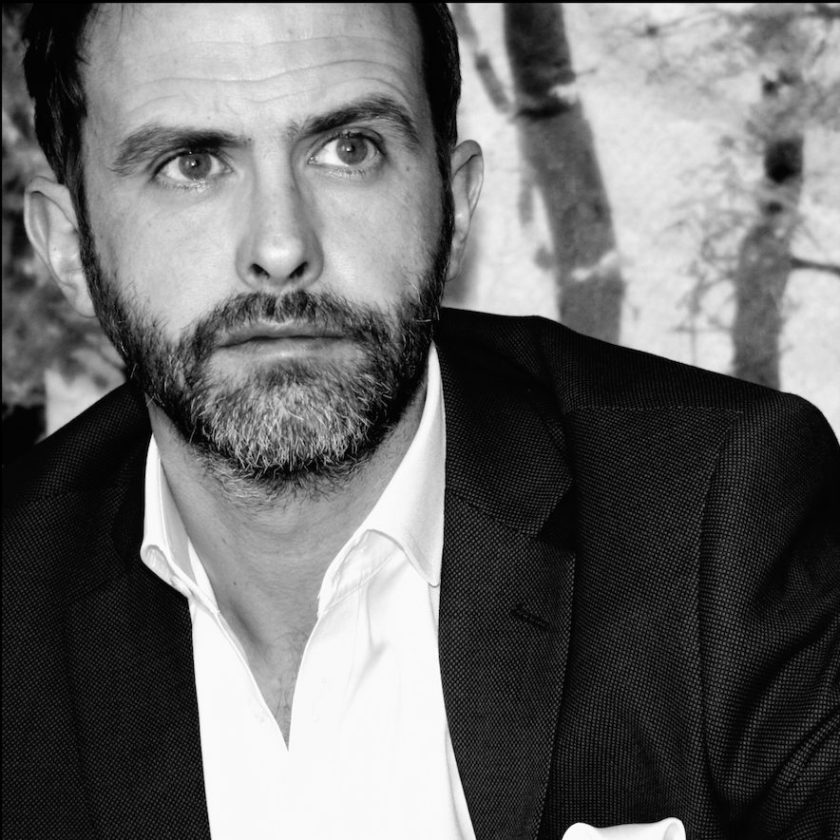

Technology can be used to both ensure greater accuracy of investment suitability data and speed up the process, says Ross Laurie, CEO, Visible Capital

As Warren Buffett’s succession plans become public, we have to wonder if he will be passing on his two top rules for investing to his successor.

Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.

Buffett also famously never buys anything unless he can write down his reasons why he’ll pay a certain price per share for a particular company.

It got me thinking that this “looking at the data” approach to investing, which has served Buffett so well over many decades, is very much at the heart of our wealth management technology.

As we have seen in the last year or so, our lives and finances are not always smooth and predictable – there are bumpy, challenging times but there are also the sunlit uplands of opportunity. There’s a real need to be regularly reviewing and assessing our financial situations, crunching the data and making adjustments – doing our homework as Buffett would probably say.

At the moment MiFID II mandates that IFAs conduct ongoing suitability checks on clients’ investment portfolios on at least an annual basis. We would argue that if investment clients are to be agile, in a position to adapt to circumstances and maximise their investments, then suitability assessments need to be carried out more frequently.

In the past, ongoing suitability assessments were onerous. I know of one company in the not too distant past who sent junior staff out to clients in taxis to collect cardboard boxes of bank statements and then worked through them with highlighter pens to record totals for income, expenditure and discretionary spending.

Those days are gone. Visible Capital’s software can do the taxi run and highlighter pen work in minutes. By using a digital solution to securely access a client’s data, our technology can then collate, categorise and enrich the client’s financial data, providing unprecedented insights. That means processes are hugely enhanced at the onboarding stage but also a rich data resource is also available for paraplanners at the click of a button for ongoing suitability assessments.

And because the process is so efficient and straightforward it can be run as often as required in the course of a year – picking up nuances of financial behaviour and stability and identifying opportunities for smart investments or signalling a requirement for a period of restraint.

FCA – accurate categorisation

At the end of April 2021 the FCA published a discussion paper (DP21/1), aimed at strengthening financial promotion rules for high-risk investments and firms approving financial promotions, with an objective to develop solutions to help millions of people “invest with confidence and save for planned and unexpected life events”.

One of the paper’s objectives is to create discussion on the “responsibility of firms to ensure accurate categorisation”. Under this section of the paper the FCA says: “We have previously received feedback that requiring firms to check evidence such as payslips or bank statements could deter potential investors for the wrong reasons, i.e. because the process would be too onerous or intrusive.”

We couldn’t agree more! And we will be contributing to the discussion paper, presenting some of the ways that technology like ours can drill down into an investor’s finances and, within minutes, reveal highly nuanced financial reporting.

And then, with their clients armed with comprehensive income and expenditure insights, financial planners can provide those clients with the very best advice.

I think Warren Buffett would approve.

This article was first published in the June 2021 issue of Professional Paraplanner