Adam Higgs, head of Research at Protection Guru, explains guaranteed insurability options, which can enable clients to increase the level of cover under a policy without further underwriting if a significant event happens.

If Covid-19 has taught us anything, it is that our lives can change very quickly. Whilst the pandemic has had an impact on everyone’s lives to a greater or lesser extent, it has also highlighted the importance of protecting one’s income against ill health. A person’s income and expenditure can and often does change for many different reasons. It is important that that the plan they have in place can adapt to ensure that clients are not left underinsured.

Guaranteed insurability options are one option that enable clients to increase the level of cover under a policy without further underwriting if a significant event happens. Within income protection plans these events can include:

- Marriage/civil partnership

- Birth/adoption of a child

- Divorce or dissolution of a civil partnership

- A new or increase in mortgage

- Increase in rent or moving to new rental accommodation

- Increase in earnings

- Separation

Each of these events can have a significant impact on a clients’ expenditure and as any such increase will need to be protected. The benefit of using a guaranteed insurability option in these scenarios is that the client will not need to go through medical underwriting and as such, if their health has declined for any reason, an additional rating will not be applied.

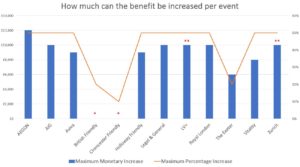

There are however limits to how much the benefit can be increased by. These limits are based on the lesser of a fixed monetary amount and a percentage of the original benefit when the policy was first taken out and the maximum increase varies across insurers.

*British Friendly and Cirencester Friendly do not apply a maximum monetary increase limit.

**Both LV= and Zurich will allow an increase of 50% of the benefit amount up to £20,000 for a significant increase in salary

Unfortunately, guaranteed insurability options will not be offered to all clients taking out protection. Most insurers do not offer them to lives where a rating has been applied and whilst other insurers do the more severely rated cases are often excluded. Of all the insurers it is only AIG, Cirencester Friendly, LV=, The Exeter and Zurich that allow such increases to rated cases.

There a certain events in a person’s life that will impact their income, expenditure or both. The birth of a child, marriage, moving home are all examples of these and perfect opportunities for paraplanners to review protection needs. Guaranteed insurability options will not be a viable option in all circumstances, however they do provide a less intrusive way of increasing cover and are particularly beneficial if the clients’ health has deteriorated making obtaining cover elsewhere more difficult.

An extended version of this analysis can be found at https://protectionguru.co.uk/2020/06/23/who-makes-it-easier-to-increase-the-amount-of-protection/