Savers are split into two camps when it comes to taking advantage of the pension freedoms, with those with smaller pots tending to withdraw more income per year. But figures also prove there is no typical drawdown client, with the rate of drawdown fluctuating.

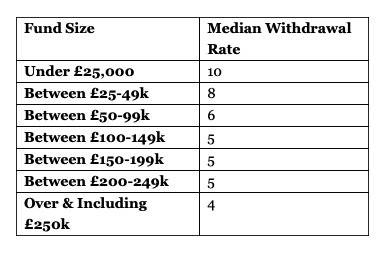

According to Royal London’s Drawdown Governance Service, a tool used by advisers to assess client’s income sustainability, investors are taking income at rates varying from 4% to 10% depending on their pot size and income needs.

Those with smaller pots below £25,000 tended to take their income at the higher rate of 10%, the findings showed. While this level would be unsustainable to last through retirement, Royal London said many of those drawing down a pot at this rate were likely to be planning on other income later in retirement.

In contrast, those with larger pots of over £250,000 were found to be taking income at a much lower median rate of 4%, while those with pension pots of between £100,000 – £200,000 were withdrawing at a rate of 5%.

Lorna Blyth, head of investment solutions, Royal London, commented: “There is no such thing as typical income drawdown customer. Regardless of pot size people are utilising income drawdown to help them structure a retirement income that meets their needs. Client segmentation is a key focus under PROD rules and this data shows a link to taking income according to a client’s needs rather than wealth.”