Is it time to pivot from worrying about inflation to worrying about employment, asks David Jane of Premier Miton’s Macro Thematic Multi Asset Team

Last year inflation was the dominant issue for financial markets. While inflation will likely remain a key issue for the next decade, as we have discussed, in the near term more important is employment.

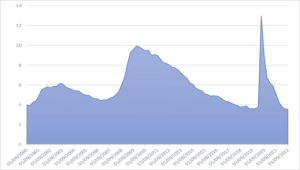

The US employment growth has been exceptionally strong since the lows of April 2020, although total employment has only recently exceeded the 2019 levels. Unemployment is back at the low levels seen in 2019. The labour market is undoubtedly tight, in part because many people left the labour market in recent years.

US unemployment rate % since 2000

Source: Bloomberg, data from 01.09.2000 to 01.09.2022

The issue in the current year is that for inflation to fall back to the levels the markets expect, the US needs to avoid a wage price spiral. This is unlikely given the strength of employment currently and the recent pick up in wage growth. It follows that markets must be expecting a material weakening of employment markets, and hence a decline in overall economic activity.

This is a conundrum for markets, if the US avoids a recession, it is because wages and inflation remain high, which implies higher bond yields and hence, lower valuations. If that comes with wages growing faster than prices, it also may mean lower company profits. The market may prefer a short, shallow recession, leading to weakening employment, not too much damage to corporate profits and lower interest rates. This could be the hoped-for Fed interest rate pivot scenario.

This is the reason the Fed is monitoring employment as one of the key metrics when setting interest rate policy. However, employment is well known to be a lagging indicator. The economy is likely to be in recession well before employment weakens materially. The worry is that considerable damage will have been done prior to any monetary policy easing from the Fed.

Short relatively hard recession

We are of the view that the recession will be short but relatively hard. This follows from our broad world view of the declining waves of weak economic activity followed by inflation, post the lockdown driven recession and inflation spike. However, inflation may settle at a higher level and growth at a lower level than the past, because of prevailing raw material and energy shortages and trending deglobalization.

This creates something of a dilemma for asset allocation at the current time. Falling inflation and a likely recession in the near term suggests falling bond yields, rising credit spreads and weak equity markets. This would imply a defensive equity stance with an emphasis on government and high quality investment grade bonds. However, if the medium term outlook is one of higher inflation the outlook for bonds remains negative, bond yields are already below our longer term inflation expectation. In a longer term inflationary environment, value and hard asset equities should outperform, but these tend to suffer in recession.

It seems this is likely to be a year which could catch people out in many ways, as there is a conflict between the short term and longer term outlooks as we come through the second post lockdown decline and recovery. Markets may rotate rapidly, as near term optimism on inflation declines it is quickly replaced by the realisation that the baseline level of inflation is likely to be much higher than the market is expecting. This might lead to a near term recovery in bonds and growth equities which is ultimately short lived.

What may further confound markets this year is the possibility that Fed policy may divide into two branches. We have already seen this in the UK, where the Bank of England has both been raising rates (to control inflation), while simultaneously expanding QE (to avert a crisis in the pensions industry). When inflation settles at a higher level than expected in the US, we could potentially see continued high US interest rates, but a loosening of liquidity conditions to prevent a disorderly decline in equities and bonds.

This year employment and liquidity both need careful monitoring and we need to be prepared to make some rapid asset allocation changes as these issues develop.

This information should not be relied upon by retail clients or investment professionals. The views provided are those of the author at the time of writing and do not constitute advice. These views are subject to change and do not necessarily reflect the views of Premier Miton Investors. The value of investments may fluctuate which will cause fund prices to fall as well as rise and investors may not get back the original amount invested.

[Main image: shivendu-shukla-3yoTPuYR9ZY-unsplash]