In this month’s article flagging funds’ three year track records, Juliet Schooling Latter, research director at FundCalibre, turns her attention to the WS Montanaro Global Select fund.

“It’s the hope that kills you” is a phrase often used in English football, referring to the thought that fans may be best not raising their expectations if their team fails. Having listened to a number of Chelsea fans in the office it is very much hope – rather than expectation – as their club starts the new Premier League season.

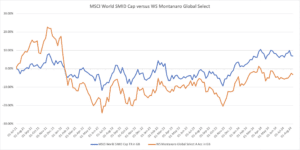

For those investing outside of large-caps it has very much been a story of hope and expectation in recent times. The hope at the back end of 2023 was that small-caps in particular would come out of their hibernation. Unfortunately, the first six months of 2024 has been more of the same, with large-caps outperforming their smaller-peers by 12% (mid-cap did not fare much better)*. It was actually the worst half-year underperformance for Global SMID cap in over a quarter of a century*.

But unlike Chelsea Football Club, there are genuine reasons to believe small-caps are set for a massive turnaround. For example, smaller companies normally account for 7-8% of the global stock market valuation, but recent underperformance has seen this fall closer to 4%, a 50-year valuation low**. This has historically been a threshold point at which we see a turn in the cycle where smaller companies start to perform better for a prolonged period.

There are other significant reasons to expect things to improve, such as the undervalued nature of small-caps resulting in increased buybacks (a strong indicator these companies feel they are undervalued) and growing M&A activity; there is also the challenges of maintaining the large-cap growth we’ve seen – indeed we’ve already seen some polarising performance from the Magnificent Seven stocks in 2024.

The kicker is rates are starting to be cut across the globe, with the recent uncertainty likely to speed this up in the US. Smaller companies are more sensitive to credit conditions and financing and are therefore likely to see more of the upside when rates are cut. In previous rate cycles, the average small-cap has outperformed large caps by over 10% in the following 12 months***.

“With macro-data becoming more supportive of global smaller company investing, it is worth noting that Global SMidCap has never looked as attractive in over 20 years on a relative basis: the asset class is trading on near record P/E and P/Book discount to large cap. With a long-term view, now may be as good a time as any for dipping a toe back into small-cap waters.”

That’s the view of George Cooke, manager of the WS Montanaro Global Select fund, an unconstrained quality growth strategy that scours the globe in search of the best small and mid-cap companies. This high-conviction fund looks for businesses that are profitable, have a long runway of growth and offer sustainable competitive advantage.

George has been at Montanaro since July 2010 and runs a number of portfolios, including the European Income fund. He also has analyst responsibilities for the healthcare sector and has previously worked as an insurance analyst.

The team behind the fund seek to identify high-quality businesses from a global universe of 11,000 listed companies. They look for firms that exhibit characteristics such as strong organic growth, high operating margins, sound ESG practices (a big part of the culture at Montanaro) and sustainable competitive advantage.

Once a company has been identified, an analyst will examine the investment case and complete quality and ESG checklists. If they are confident in the company’s potential for long-term ownership in the fund, they present it to the Investment Committee for approval. This typically brings the universe of eligible companies down to 200 names. Beyond this stage a valuation analysis is undertaken to determine the intrinsic value of the business – the team then produce a target price and issue an official recommendation (Strong buy/Buy/Hold) based on their conviction. The outcome of this process is a high-conviction portfolio of between 25-40 best ideas.

Holdings tend to be reduced if an analyst’s target price is met, with top slicing of positions occurring when they account for more than 7.5% of the fund. The team have no restrictions on country exposure but can have a maximum of 50% in any one sector. The fund endeavours to be well diversified across sectors, although they prefer to avoid commercial banks and companies that are sensitive to commodity cycles.

Some of the largest holdings include Tyler Technologies (5.4%)^, the leading provider of software to the US Government sector – the firm recently produced results ahead of expectations in the first quarter of 2024*. Others include Rollins (5%), a US firm which operates globally through its subsidiaries in the pest, termite and wildlife control industry; and Games Workshop (5%), the UK manufacturer of miniature wargames, such as Warhammer^. The top 10 holdings account for almost half (44.6%) of the fund, reflecting its high conviction nature^.

This is about as active a strategy as an investor could find. The market has been challenging, but ultimately it is all about whether you feel the manager and team can produce long-term performance through their stock picking. George is highly experienced and has a track record of delivering strong returns investing in both small and mid-cap companies. We believe that this fund is in good hands and is ideally placed for any turnaround in fortunes for this segment of the market.

*Source: Montanaro Global Select – Q2, 2024 Update

**Source: The Global Smaller Companies Trust, June 2024

***Source: JPMorgan Securities, 31 May 2024

^Source: Provider factsheet, figures at 28 June 2024

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.