Juliet Schooling Latter, research director, FundCalibre continues her column for Professional Paraplanner with analysis of Troy Global Income managed by James Harries.

When James Harries left Newton – and it’s huge bank of global analysts – to go to boutique house Troy and set up a new global income fund, investors were left with a dilemma: to stay or to follow.

James had successfully run the Newton Global Income fund (now BNY Mellon Global Income fund) for just over a decade, and assets had grown to around £4.5 billion. Nick Clay, the alternate manager on the fund, who had 25 years experience under his belt, took over.

Three years on since the launch of Troy Global Income, what can hindsight tell us?

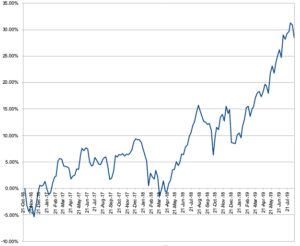

Well, the good news is that investors have been rewarded whatever their choice – there is little to choose between the two funds over the period, and both have outperformed the sector average. Troy Global Income comes out just ahead, with returns of 28.53%*, while BNY Mellon Global Income returned 27.81%*. The IA Global Income sector returned 19.63%*.

But what I particularly like about the Troy fund is James’ focus on capital preservation and he has proved he can still outperform in falling markets. Take Q4 2018 for example. Worries about rising interest rates in the US led to markets tumbling – the MSCI World lost some 11.5%**. Troy Global income was down just 3.74%** at the end of the year, while his average peer had lost 8.9%**.

This downside protection means that even though markets have rallied strongly since, the fund has still significantly outperformed over one year, returning 12.57%*** compared with 5%*** for the MSCI World and 3.44%*** for the sector.

James has achieved this success by using both Troy’s view on broader economic and industry factors and his own research into individual companies’ merits. He looks for high-quality shares at a good price, and focuses on those businesses that make high returns on capital employed. He particularly likes companies whose management is thinking about the next ten years.

The yield on the fund is a modest 2.7%^ – James abandoned the rigorous yield targets he had at Newton when he set up this fund – but it isn’t too far off the average in the sector, the aim is for it to grow each year, and total returns are excellent.

Turnover of stocks has been quite low over the past three years, but that does not mean James hasn’t been coming up with new ideas, and has been flexible in applying them in the fund.

Sizing of positions is based on the quality of the company and the valuation, but won’t exceed 6% of the portfolio’s assets. There are no sector or geography constraints, so James has a lot of flexibility. He’s not doing so at the moment, but he can also invest up to 20% in government bonds, corporate bonds, REITs and cash if he wishes.

Right now the fund has around 51%^ invested in North America, 24%^ in the UK, 19%^ in Europe and 6%^ in Asia. James believes that Europe in particular is an untapped opportunity – there are plenty of companies where the dividend is covered and funded by cash on balance sheets.

In my view, a less buoyant market environment should be beneficial for this fund, and James’ total return mind set and cautious outlook is ideal for the number of uncertainties in the world right now.

*Source: FE Analytics, total returns in sterling, 17 October 2016 to 15 August 2019

** Source: FE Analytics, total returns in sterling, 1 October 2018 to 31 December 2018

*** Source: FE Analytics, total returns in sterling, one year to 15 August 2019

^Source: fund factsheet, 31 July 2019

Past performance is not a reliable guide to future returns. Juliet’s views are her own and do not constitute financial advice.