In her monthly column for Professional Paraplanner, Juliet Schooling Latter, research director, FundCalibre looks at fund and fund managers at or approaching their three-year track record. This month she reviews the Man GLG High Yield Opportunities fund.

“The outlook for bonds has gone from bleak to dire” – that’s the headline which stood out from all the fixed income articles I read towards the end of last year.

It’s a statement which is hard to argue with given changes in monetary policy direction, stubborn inflation and increasing pressures on many businesses. The former is perhaps the most worrying of all for markets as we know central banks globally are unlikely to produce a cohesive response – we’ve also seen what happens if they move too aggressively.

The bottom line is, a lot of government bonds are facing the strong possibility of making losses in a rate rising environment, while many investment grade bonds are yielding well below 3 per cent. Dispersion is the order of the day in 2022.

“It is likely to be a year where returns are driven by idiosyncratic risks for individual bonds, rewarding judicious stock picking. “That’s according to Mike Scott, the manager of the Man GLG High Yield Opportunities fund.

Mike was recruited from Schroders (where he had an exceptional track record on his high yield fund) in September 2018 with a view to launching this fund. It is an unconstrained global high yield bond portfolio and Mike has a ‘go anywhere’ approach looking for mispriced opportunities from across the speculative end of the market and trading them. He buys opportunities he thinks are too cheap, and also shorts some he thinks are too expensive, enabling him to profit when the price falls.

His investment universe starts with around 1,500 names. This is initially reduced through a series of quantitative metrics to find attractively priced ideas which consists of around 150-200 names. From this list, Mike will conduct a more thorough analysis, building a watchlist of 100-150 with good fundamentals on an individual basis and macro tailwinds to support a recovery in price. This also entails analysis on the wider credit environment.

The final portfolio consists of 60-80 names, based on the strength of their fundamentals. These positions will be weighted depending on how compelling the opportunity set with reference to which sector or country they are in, the liquidity, the seniority of the debt and what difference each idea will make to the rest of the portfolio. Mike doesn’t wish to be concentrated into one area or be exposed to one factor. He wishes to have a diverse range of ideas to enable a portfolio that can benefit in all backdrops.

The typical holding period is around one year, so positions can turn around quickly, especially in the more opportunistic trades, which gives an overall portfolio turnover of around 75-80 per cent.

At least two thirds of the fund will need to be in sub investment grade bonds. Mike wants a diverse range of return drivers and therefore will have a spread of global opportunities, albeit with a natural preference for UK, North American and European markets. The fund will be at least 80 per cent hedged back to sterling.

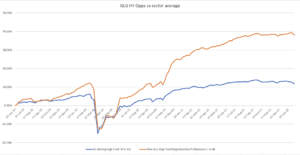

Source: FE Fundinfo

Despite the current challenges, Mike says high yield markets have historically performed well during periods of inflation and can also continue to perform if rates rise.

He says: “Companies with pricing power are in a far better position to navigate inflationary pressures. We believe this should be a strong theme in high yield strategies today. It would also influence geographic positioning. For instance, we see greater inflationary pressures in the US, while European companies are at an earlier point in the cycle and tend to have less leverage and more compelling valuations*.

“We are positive on the services, health-care and telecoms sectors, where rising costs can be passed on, while less so on the automotive sector and consumer discretionary companies*.”

Since its launch in June 2019, the fund has returned 38 per cent, compared to just 12 per cent for the average fund in the IA Sterling High Yield Bond sector**. Ongoing charges stand at 0.75 per cent***, with the fund offering an attractive yield of 5.56 per cent***.

This fund is not for the faint hearted – Mike takes risks, but his experience and the fund’s flexibility allows him to find opportunities others may miss or avoid. The concentrated portfolio offers a different, but attractive return profile to his competitors, aided by his strong track record. It is a solid option for investors for solutions in the bond market in these challenging times.

*Source: MAN GLG – High Yield Investing in 2022

**Source: FE fundinfo, total returns in sterling, 6 June 2019 to 28 January 2022

***Source: fund factsheet, 31 December 2021

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.