In her latest analysis of funds marking three year events, Juliet Schooling Latter, research director at FundCalibre, looks at the Liontrust Sustainable Future Managed, which despite returning over 350% for investors since 2005 has suffered in the past three years. But has the fund now turned a corner?

Arguably the most important part of our jobs as fund managers is to scratch beneath the surface of any theme or strategy to fully appreciate the pros and cons of its investment approach.

Take ESG or sustainable investing as an example. Most headlines tell you that, after a period of strong growth, the industry has faced a number of headwinds in recent years including war, a shift away from growth investing, rising interest rates and an anti-ESG sentiment which has become a key feature of right-wing politics.

You’d expect some pullback in tough times, but the long-term fundamentals of sustainable investing remain strong. For example, only last year, research from DeVere Group found almost three quarters of Millennials and Generation Z demand environmental, social, and governance (ESG) in their investment portfolios*.

The reality is that societal changes for sustainable strategies cover a raft of mainstream issues to create a better world. Healthcare is a prime example. For us it all boils down to experience and track record, and this month’s fund has both in abundance.

The Liontrust Sustainable Future Managed fund was launched in February 2001 and has returned 351.8% to investors in the past 20 years**.

Managers Peter Michaelis and Simon Clements have over 40 years of combined industry experience between them and are part of a team of 22 investment professionals who manage £9.2bn of assets.

Every investment in this fund has to meet four set criteria: thematic drivers; sustainable credentials; good fundamentals; and attractive valuation. The team has identified three megatrends with strong and dependable growth prospects. These are: better resource efficiency (cleaner); improved health (healthier); and greater safety and resilience (safer). Within these three buckets the team has identified 22 areas of predictable and resilient growth.

The team uses a sustainability matrix to analyse each company in terms of product sustainability and management quality. The management want companies with robust business fundamentals and a proven ability to deliver high returns on equity through sustaining margins and asset turnover.

The valuation stage sees the team integrate its view of quality into these businesses, predicting the likely sales, earnings and other financial returns they expect to see from these companies over the next five years.

On the fixed income side, the managers aim to produce an income yield, with the prospect of some capital growth. The managers tend to focus on individual bottom-up stock selection on the equities side, while there is a bit more of a macro focus for fixed income. The final portfolio consists of 40-60 stocks.

Sticking to the process and finding opportunities

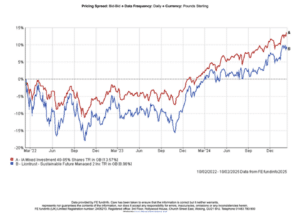

When speaking to Peter and Simon, they are happy to acknowledge that despite excellent long-term performance, investors would have questions over the three-year figures. Looking deeper at the performance you can see the vast majority of challenges came in 2022, when the fund fell 20.5% (vs. 10% for the IA Mixed Investment 40-85% Shares sector)***. The pair point to the unique challenges of war breaking out, while rising rates hit both quality growth businesses, and particularly the fixed income market, hard.

“We had not seen the fixed income market so violent, not even during the Global Financial Crisis. Since then it has been more about the intense concentration focus on the US mega-caps. It has been unusual, but the long-term strategy has delivered and there is no reason why it won’t deliver again,” Peter says.

The pair are keen to point out they are still finding plenty of opportunities in each of those three megatrends. Within the better resource and efficiency theme the team highlight the likes of Core & Main, which provides infrastructure around water distribution. The team say the average age for water infrastructure in the US is 45 years old and that 15% of drinking water is lost each year due to leaks.

Within improved health they have the likes of West Pharmaceuticals, which helps deliver complex critical medicine safely and reliably. The business has 7-9% revenue growth and an expected five-year return on invested capital of 20%****.

Names in the greater safety and resilience bucket include Palo Alto, a cybersecurity company. Peter says: “Digital security is an arms race. It is a $100bn market and grows at mid-teens per cent each year. It does not stop if an economy slows because hackers don’t. They use AI so you have to use AI to stop it.”

Is Trump such a bad thing?

As for the impact of Trump and his apparent opposition to all things ESG, not only has the fund performed well since the market priced in his victory, but it previously saw some of its strongest performance during his first term. Again, it appears to be a case of all not being as it seems.

Bringing productivity closer to home through reshoring also brings benefits to their portfolio. Companies like Advanced Drainage Systems, which uses recycled plastics, have the number one market share in the US. Simon says if you’re going to build factories, you’re going to need businesses like Keyence, which is a leader in factory efficiency.

“Many of our companies would benefit from that investment – the last few years a lot of the investment has gone into AI. Broad investment in the economy tends to be done in an efficient way to usher in a move to a more stable economy. The small and medium-sized businesses should benefit,” Simon adds.

Backed by an experienced and excellent team, this fund has everything in its favour. The strength of the process is highlighted by those long-term performance figures and we like the fact the team are steadfast in sticking to their process. Sustainability comes in various guises and this team are well positioned to find those companies which can bring positive change to the world.

Liontrust Sustainable Future Managed 2022-2025

*Source: Corporate Adviser, 23 May 2024

**Source: FE Analytics, total returns in pounds sterling, 10 February 2005 to 10 February 2025

***Source: FE Analytics, discrete calendar year performance

****Source: fund presentation, January 2025

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.

Main image: bobby-barr-fD7H3vhiBC8-unsplash