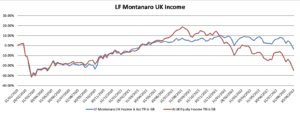

In her regular look at funds which have reached a three-year milestone, either as a fund or in terms of manager tenure, Juliet Schooling Latter, research director, FundCalibre delves into the LF Montanaro UK Income fund.

“Our fund has had a triple whammy of headwinds this year. Not only has UK small-cap underperformed, but so has quality and growth as the investor’ focus on interest rates and inflation – rather than economic fundamentals – resulted in a valuation-led sell-off.”

The view of LF Montanaro UK Income co-manager Guido Dacie-Lombardo is refreshingly honest to hear as we understand when a style is out of favour it is out of favour. As long as a manager stays true to their investment style – as is the case with this fund – we are confident things will turn.

You can’t help but think of the proverbial expression “it’s darkest before dawn” for this portfolio – although perhaps not for the wider economy. As Guido points out, there are signs that rising interest rates are beginning to bite from an economic sense, with mortgage rates the perfect example of the consumer being squeezed.

Effectively we are facing a more challenging economic outlook as we head into 2023, a scenario that often poses challenges for consumer facing companies, as well as those with levered balance sheets and weak pricing power.

Guido says this is where this fund comes into its own. He says: “When earnings start to decline and you have an economic downturn, historically quality is a good place to hide. Suddenly investor attention goes from a valuation-led sell-off to a focus on company fundamentals – good earnings, strong balance sheets and market leaders.

“Our fund is well-positioned for this. About 40 per cent of our companies have got net cash on their balance sheets and we tend to invest in market leaders who take market share in difficult periods.”

Guido join Montanaro back in 2015 and co-manages this portfolio with business founder Charles Montanaro. This version of the strategy was launched in January 2020, with Guido taking the reins in July of that year.

The investment process starts with a simple philosophy; invest in companies you can understand, buy things which are growing, back quality management, engage with your companies and don’t over trade. Wider macroeconomic factors are ignored.

The team screens for companies using its own internal quality metrics. Valuations do not form part of this initial process but are considered at a later stage. The team invests in simple understandable businesses for the long term and is unafraid of completely avoiding complex sectors such as biotech, miners, insurers or banks.

Montanaro’s analysts conduct detailed fundamental analysis on every potential holding. Only after a company has passed a number of rigorous internal tests can it be added to the approved list for potential investment. The fund is invested almost entirely in quality mid and small-cap stocks listed in the UK.

The final portfolio will typically hold between 40-50 stocks at any one time – all of which are given a risk score. As with all Montanaro funds, ESG is at the heart of the process.

As I mentioned earlier, the team has stuck true to its investment principles in a tough year thus far. The quality focus has also resulted in an avoidance of energy companies – as they are not in control of their own destiny and beholden to the oil price.

Changes have focused on ensuring diversification of income streams across sectors, as well as reducing balance sheet leverage and exposure to consumer facing companies.

Examples of existing holdings which fit the mould in this uncertain outlook include Kainos – a business which provides digital technology solutions. Information technology is an area the fund has an overweight to, with Guido pointing to the lack of energy, low consumer exposure and low input costs as attractions.

“Kainos provides IT/digitisation services, primarily to the UK government, to digitise a number of government and citizen interactions. So, for example, when you want to apply for a driving license it used to be a paper-based process. Kainos has designed an online system to make that easier, the same with passports. More companies will be digitised in the coming years and Kainos will be a market-leading player in that space.

“They also have an implementation agreement with large-cap US business Workday, where it has become its’ leading partner in Europe,” he says.

Guido cites Big Yellow as another market leader they’ve had long-term exposure to. He says the business has already been through various economic cycles, and with market leading management and occupancy rates of almost 90 per cent, they now have a stable consumer base on both the residential and commercial side.

“Occupancy levels give them pricing power and they can expand their footprint into new developments.”

The fund currently yields 4.25 per cent and with 40 per cent of companies with net cash and dividend cover in a healthy state – Guido is confident dividends will remain resilient.

If quality does come to the fore this will be an ideal place to invest. The team is vast and experienced, using its own high-quality research to find opportunities often missed by others.

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.