This month, Juliet Schooling Latter, research director FundCalibre, considers the currently discounted UK market and a mid-cap fund that has been around since 1969 but which has had a new manager at the helm for three years.

Having read swathes of market outlooks in the past few weeks it seems 2022 holds no guarantees from an investor perspective, as uncertainty rules the market.

It’s in times like these that we, as an investment team, always go back to basics: focus on the long-term, have a reasonable exposure to mid and small-caps and look for value in the market.

This puts the home market firmly on our radar, given the valuation discount UK equities are currently operating at relative to their international peers.

But how best to tap into this? One fund worth considering is the Axa Framlington UK Select Opportunities fund, managed by Chris St John. Chris joined Axa Investment Management in 2005 and took charge of the Mid Cap fund from its inception in 2011. He was made deputy manager of this fund in 2013, ahead of taking over from veteran manager Nigel Thomas when he retired three years ago.

The UK Select Opportunities fund is a multi-cap vehicle, which typically holds between 60-90 stocks. The process across this and the Mid-Cap fund are similar, however the remit for this offering is wider.

The team is looking for those businesses it thinks can grow and compound their economic output, with balance sheet strength supportive of that growth. Chris says: “It’s that continued focus on appropriately financed companies that we search for, so that management teams are working for the equity holders rather than any of the other creditors of the business, such as banks.”

There are three stages to the process. The first is a thematic overview looking at the key global macro factors and themes that should drive growth going forward, such as increasing life expectancy, digital transformation, and a low-carbon economy.

The second stage is bottom-up stock analysis. The thematic overview in stage one gives Chris an indication as to where the companies benefiting from growth tailwinds are likely to be, but the analysis helps define and evaluate them, and to see how much they are set to benefit from the trends.

Examples of UK corporate themes include service, technological disruption, changing corporate architecture, the stronger getting stronger, and the impact of the Covid crunch.

In this analysis, the team will look at qualitative factors such as the management’s track record in delivering earnings and its funding strategy. Chris will also look for positive signs such as a company experiencing organic growth, exhibiting good pricing power, and having high barriers to entry. He will also look at quantitative factors – earnings yield and growth, dividend growth potential, free cash-flow yield and return on capital. These will demonstrate how efficient the company is at operating its business.

Chris will then meet company management. This is a very important part of the process. It allows him and his team to test their analysis and interpretation against the people who are set to implement it. This helps verify the investment case.

Having established the investment case for a company, Chris then moves on to valuations. Here, he will look at a variety of metrics for comparison purposes. While he wants to find growth, he doesn’t want to overpay for it. The quantitative analysis from earlier feeds into this part of the process.

This work then culminates in stage three: portfolio construction. The overriding goal is to maximise the growth potential, but not at the expense of risk.

Chris says: “You’re looking for those companies that have very high service levels and are making a real difference to customers when price transparency is high. So rather than just selling a widget, it’s better to be involved in the design of the widget. They’re adding value to the customer by solving a problem for them.”

Ultimately, there are no major restrictions on investment on a company-by-company basis. A maximum position of 6 per cent can be held in FTSE 100 companies falling to 4 and 3 per cent for FTSE 250 and small-cap companies respectively.

Amongst the top 10 holdings at present are the likes of Diageo (4.3 per cent), Experian (3.5 per cent) and Auto Trader Group (2.6 per cent)*. Annual charges stand at 0.83 per cent*.

We like this fund’s robust process and the fact that the manager uses thematic long-term ideas to help construct a portfolio of dynamic growth companies that should benefit from these trends. The flexibility to invest across the market spectrum is also useful.

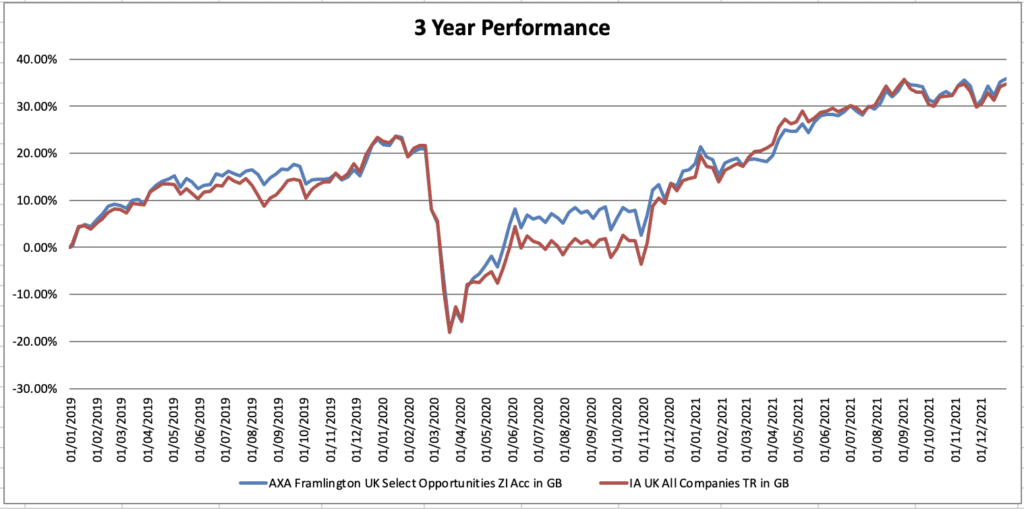

Over the past three years, the fund is second quartile having returned 35 9 percent – just ahead of the sector average of 34.2 per cent**. The UK has not been the easiest market in recent years, but the stars may well be aligning for this fund in the future.

*Source: Fund factsheet, 30 November 2021

**Source: FE fundinfo, total returns in sterling, three years to 6 January 2022.

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are her own and do not constitute financial advice.