In her latest article on funds at or approaching a three-year track record, Juliet Schooling Latter, research director, FundCalibre, looks at the Artemis Target Return Bond fund.

Stephen Snowden: “Given current yields (and spread levels) not owning fixed-income assets at this point would come with a large opportunity cost. Within our investable universe, we believe we are being more than adequately compensated for the risk we are taking in certain areas.”

That’s the view of the bond fund veteran, who feels valuations in selected areas of the bond market are starting to look more attractive than they were – although he remains cautious towards emerging market bonds, peripherical eurozone risk and the lower-rated end of the high yield market.

It’s a view I share, with recession starting to edge inflation as the biggest threat to markets. Bonds can act as a diversifier to equities –with current bond yields offering a greater margin of safety. The challenge is timing these changes. In my opinion credit spreads will continue to widen – which may increase the attraction of investment grade and high yield.

Having joined Artemis in 2019, Stephen now runs a trio of portfolios for the asset manager – including the Artemis Target Return Bond fund. This is of interest to us as it is one of the handful of funds sitting in the much-maligned Investment Association Targeted Absolute Return Sector that we like.

In the past, I have labelled the sector a zoo, with many different ‘animals’ – long-only, long-short, UK-centric, global, and fixed interest funds being just some of the beasts sitting there – which makes no sense to me at all.

But there are good funds in there, so for investors simply to put a black mark against all of them is a mistake. Some do exactly what they say on the tin.

But the wider failings of the sector have seen investors walk away in droves; however, there is an educational element which is also letting these funds down and Stephen has been very clear on this point in the past. “Attempting to deliver positive returns in all market conditions is a noble quest – but it is doomed to fail. It is an unbreakable law that returns can only come if we accept risk,” he said last year.

As a result, he is keen to stress the term ‘target return’ rather than ‘absolute return’. Adding that fund managers should be straight with investors as to what can (and can’t) be achieved in the fixed income market.

This fund targets an annual return of at least the Bank of England Base rate + 2.5 percentage points a year after fees by investing in government and corporate bonds as well as asset-backed and mortgage-backed securities.

Stephen’s philosophy is that markets are inefficient and financial operators often behave irrationally. Liquidity constraints, portfolio, and benchmark restrictions – and increasingly passive strategies – all create opportunities for active managers. To take advantage of this, the fund is flexible, with investments across the fixed income spectrum and the ability to go both long and short.

In terms of those challenges mentioned, Stephen says there are two headwinds facing those investing in targeted absolute return bonds funds. The first is that bonds are expensive to short (meaning you pay out an income rather than receive one); the second is they tend to do best in volatile markets (something we have not seen too much of since the global financial crisis in 2008-09) until more recently.

Maximising risk-adjusted returns is the goal, and Stephen looks to generate returns from six different sources: asset allocation, stock selection, ratings, sector selection, yield curve and duration.

The fund is broken down into three modules: credit, rates and carry – these are the measured risks Stephen talks about. The carry module tends to be the least volatile and consists of short-duration investment-grade credit.

The rates module focuses on government bond markets across the world, incorporating views on inflation, interest rates and yield curves, while the credit module focuses on fundamental research and finding stock-specific opportunities across investment grade, high yield, and emerging markets. All three help build this unconstrained portfolio.

Stephen has an exceptional track record dating back more than two decades, having worked at both Aegon and Old Mutual in that time. He and his co-manager Juan Valenzuela have 20 years’ combined experience in managing targeted absolute return bond funds.

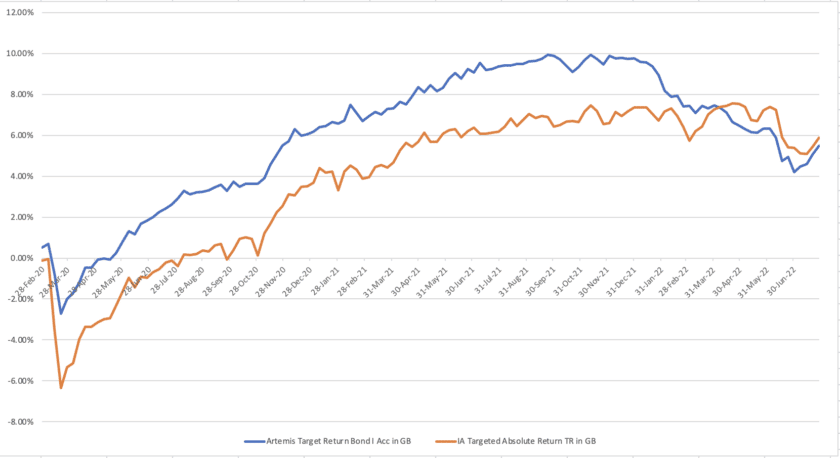

Since launching in December 2019, the fund has returned a reasonable 5.8 per cent, just shy of the 6 per cent return of the sector average*. It has an attractive ongoing charge of 0.4 per cent.

This really is a gem in a challenged sector. It’s ideal for those risk averse investors who want a better return than cash. The fund has a solid, flexible process, combined with tight risk management. It’s also fairly priced, in a sector where there have been issues with cost. It’s a rock solid, core holding for investors.

*Source: FE fundinfo returns in sterling, 3 December 2019 to 3 August 2022

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Juliet’s views are his own and do not constitute financial advice.