A flaw in rules could lead to the loss of lifetime allowance protection on scheme buy-out. Charlene Young, senior technical consultant at AJ Bell explains

According to recent correspondence, HMRC has taken the view that pension scheme buy-outs do not constitute “permitted transfers”. This has important implications for a small number of clients whose lifetime allowance (LTA) protection could be at risk.

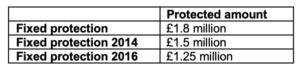

The LTA has been a popular tax lever for different Chancellors over the years. From its peak at £1.8 million in 2012, it fell as far as £1m in 2016 and is currently pegged at £1,073,100 for the current tax year.

Alongside the cuts to the LTA, various protection measures were introduced, including “fixed protection”. Individuals could apply to HMRC for fixed protection to maintain their lifetime allowance at the previous higher level, if certain conditions continue to be met.

Fixed Protection

Fixed protection can be lost if an individual is deemed to have accrued benefits under a pension scheme. Examples of benefit accrual include paying in contributions or making a transfer that is not a “permitted transfer” for the purposes of the legislation.

Scheme buy-outs

A scheme buy-out is where a whole scheme (and the risks of managing that scheme) is transferred to an insurance company in exchange for a single payment by the scheme trustees. The insurance company takes over the administration of the pension scheme and pays pension entitlement to the members of the scheme. It’s a well-established and popular method of de-risking defined benefit schemes as it removes the scheme liability from the employer’s balance sheet.

In the past, buy-outs have been completed without affecting transitional LTA protection scheme members might hold in respect of benefits built up prior to pensions “A-day” in 2006. However, in recent correspondence with the Association of Pension Lawyers (APL) HMRC has indicated that clients already in receipt of their pension from the scheme would lose their fixed protection as a result of the buy-out exercise.

As they’re already taking benefits from the transferring scheme those, benefits won’t be affected, but the loss of protection would impact pension funds they have elsewhere that have yet to be crystallised. Loss of fixed protection would mean any future benefit crystallisation events would take place with reference to the standard lifetime allowance (or any available dormant individual protection if applicable).

Legislation provides that any member with enhanced protection is not affected on buy out and neither is a deferred member who holds fixed protection.

However, no such provision exists in the regulations for fixed protection where pensions are already in payment. HMRC has indicated to the APL that they have no plans to revisit the legislation or guidance soon.

Overcoming the issues

Whilst this is only likely to affect a small number of individuals, the tax consequences for these individuals could be severe so identification and communication with members is key where a scheme is considering a buy-out.

Advisers will play a key role in helping defined benefit scheme trustees who are embarking on a buy out to identify members with fixed protection.

It is not easy for the scheme alone to do this as it is not just a case of looking at those in receipt of high annual pensions or those with large entitlements who are shortly due to take benefits. A pension member could be receiving a modest annual pension from the scheme concerned but hold fixed protection as they have significant benefits uncrystallised elsewhere, for example in a SIPP.

Identification and communication could take considerable time and delay the buy-out exercise itself, but once this has been done its likely work can continue with modifications and putting in extra steps for those affected members.

If HMRC continues with its current position, it might take a member (or class of members) to challenge it through the courts – at great cost on both sides.

The straightforward option would be for HMRC to ensure the legislation is corrected without delay and backdated in line with the regulations for enhanced protection. Surely it could not have been the intention of policy makers to provide regulations to protect those with enhanced protection but not certain individuals with fixed protection? It is hardly a loophole which individuals can choose to exploit.