Deglobilisation has moved a step further into what David Jane, Fund Manager, Premier Miton Macro Thematic Multi Asset Team, Premier Miton Investors, terms a new form of the ‘Great Game’.

We have for some time considered that we are in a deglobalising world. Most investors understand this now. More recently we suggested that events were moving a step further, which we called a new form of the ‘Great Game’. In the past the British, Persian and Russian empires fought for strategic control of trades routes in the near east. We are seeing similar developments in the way global trade relationships have been developing recently.

We believe those with the strongest hand will win this game and we identified the US as the most powerful, with its huge natural resources, military might and large wealthy consumer class. Recent events suggest it will leverage these strengths aggressively.

The incoming President’s suggestions that the US has designs on expanding its territory into Canada, and Greenland, and on taking back control of the Panama canal, may seem outlandish at first glance. Put into the context of the longer-term history of the US they seem less so. The history of the US is one of continuous territorial expansion. From a colony of 13 states on the east coast of the American mainland, the US has expanded continuously throughout its history, taking territory by force or negotiation from neighbouring countries or further afield. Louisiana and Alaska were purchased from France and Russia respectively. The southwestern states were gained from Mexico by force. The mid-west and western states were won by the defeat of the native tribes.

Physical boundaries alone only partly show the expansion of the US as it has effective control of the foreign policy of NATO members, the Five Eyes member states and Japan.

In this context, the US’s desire to regain control of the Panama canal or to get control of the huge natural resources of Canada and Greenland stops appearing so outlandish. The canal is a key route for global trade, particularly from China to the US east coast, and China has in recent years used soft power and infrastructure investments to benefit its access to this route. Hong Kong companies control the ports at either end of the canal.

Similarly, control of the Arctic Sea routes and the huge hydrocarbon deposits believed to exist there will be a major issue in the coming years. At present, Russia is the dominant power in the Arctic. Seen in this context, greater influence over Greenland and Canada are major geopolitical priorities for the US in the long term.

At this point it is unclear how all this posturing will play out. The US clearly has the twin priorities of control of natural resources and access to markets. Now it has successfully decoupled Europe from Russian natural gas it will want to expand its own ability to supply that market. Similarly, access to trade routes is a key Chinese priority and the US will desire to weaken their influence where they can.

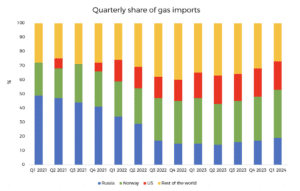

The chart below shows how the US (and Norway) have replaced Russia in Europe’s energy markets. Russia’s share (in blue) will fall further now that supplies via the Ukrainian pipeline have ended.

Source: European Commission quarterly report on European gas markets, Q1 2024

Our view remains that the strong will get stronger. The US currently has powerful positions in most of the key areas. Its priorities seem clear, to have greater reserves of hydrocarbons and critical minerals, and more influence over trade routes. From an investment point of view these ongoing developments support our broad view that economic growth will continue to diverge globally. The strong will suck economic activity away from the weak. At the same time increasing friction and trade barriers will inevitably lead to higher inflation, especially in the weaker economies. This suggests ongoing rises in bond yields and a strong dollar. Whether equities can withstand the impact of rising yields remains to be seen.

Important information

The views provided are those of the author at the time of writing and do not constitute advice. These views are subject to change and do not necessarily reflect the views of Premier Miton Investors. The value of investments may fluctuate which will cause fund prices to fall as well as rise and investors may not get back the original amount invested. Reference to any particular investment does not constitute a recommendation to buy or sell the investment.