The Sugarhill Gang were musical pioneers introducing hip hop music to a wide audience. Back in 1979 they created the first rap song to enter the US Hot 100 with a seminal song in hip-hop history, peaking, sadly, at a rather modest, number 36. The song title? “Rapper’s Delight”. Forty years on, and in the more prosaic world of financial services rather than New York street culture, let’s turn our attention to ‘Wrappers delight’.

Pension and ISA provide,of course,a particular delight, but those tax efficiencies have been well rehearsed elsewhere so let’s take them as a given. Instead let’s focus on the dilemma of holding OEICs outright or wrapping them within a bond. At Prudential, we offer both and have no particular axe to grind. We do however get upset when this is couched as a bonds versus OEICs debate. Instead, it’s all about bonds and OEICs, and finding the right blend.

Starting with OEICs, the key to understanding OEIC taxation is to understand the set-up of the OEIC itself.

Consider an umbrella OEIC with ten (sub) funds comprising different investment objectives where the assets of each are separate from those of other funds. An investor might buy shares in just one fund, or perhaps all ten. Income shares will entitle the investor to receive the appropriate distributable income. In contrast, for holders of accumulation shares, the income is automatically transferred to (and retained as part) of the capital assets of the fund and will be reflected in the share price. Tax rules state that the umbrella company isn’t treated as a company for tax purposes. It’s ignored and instead each separate fund is treated as a separate entity for UK tax purposes. So, what tax information arises from this?

The (sub) fund

Realised capital gains within the fund – generally exempt from UK tax.

• Dividends received by the fund – generally exempt from UK tax.

• Other types of income received by the fund – subject to corporation tax, but after deducting allowable management expenses and, if relevant, the amount of interest distributions.

• Distributions to individuals – dividends will be paid except where more than 60% of a fund’s property has been invested throughout the distribution period in interest paying investments, in which case it may pay interest.

The knock-on consequences for clients are therefore as follows.

The individual

Capital gains – shareholders may be liable to CGT upon transfer or sale of their shares.

• Switching between sub funds – also treated as a disposal for CGT purposes, but exchanges of shares between classes within a sub fund are generally not (e.g. between income and accumulation).

• Dividends and interest received and accumulated – clients liable to tax at basic, higher or additional rate may be taxable depending on the circumstances (see below).

Income tax

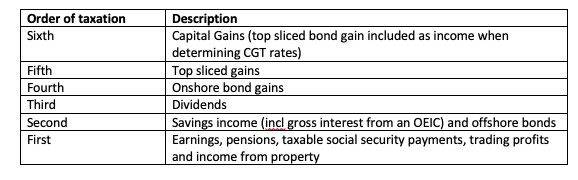

To understand the tax implications for clients, you need to revisit the order of tax rules

Without getting too bogged down with figures, these points are important to OEIC investors

a. There may be (some) personal allowance to offset against OEIC income depending on circumstances.

b. There is a Personal Savings Allowance (PSA) Nil Rate which can be applied to the first £1,000 of interest for basic rate taxpayers, and the first £500 for higher rate taxpayers.

c. There is a 0% starting rate for savings available to those taxpayers with total non-savings income of less than their personal allowance plus £5,000.

d. There is a Dividend Allowance Nil Rate of £2,000 and dividends above that are taxed at a lower rate of taxation than other income

• 5% for dividends in the basic rate band

• 5% for dividends in the higher rate band

• 1% for dividends in the additional rate band

For certain clients, OEIC income might therefore be tax free – very nice.

Not everyone though will have these allowances fully available. Consider business owners. Chances are they will use up the Dividend ‘allowance’ and basic rate band with a modest salary, large dividend strategy. Many will just have a £500 PSA to play with.

Older clients with a good fixed pension provision and those of working age with reasonable jobs, may also have little or no basic rate tax band remaining. This puts their investment income into the higher tax bands with a PSA of just £500. The dividend ‘allowance’ of £2,000 is attractive but a £65,000 or so, portfolio, could easily wipe it out.

For those clients using the income for living expenses, then the minutiae of the tax system may be of limited interest; but for those savers rolling up the income, then a different story emerges.

If that OEIC fund is purchased within a non-income producing investment bond, how is that income taxed? Dividends become exempt (both onshore and offshore). Interest is taxed at 20% onshore, and exempt offshore. The bond owner will be subject to the chargeable events regime.

Consider a higher rate client accessing their UK bond after becoming basic rate in retirement. That client might only suffer the internal taxation within the bond with the tax credit taking care of their basic rate tax liability. Offshore? That basic rate taxpayer will have to pay 20% tax. Alternatively, the conditions could exist, or be created, where the gain is within allowances – enabling up to a gain of £18,500 in 2019/20 to be tax free.

If regular withdrawals are required at some point in lieu of income, then up to 5% of investment premiums can be taken tax deferred each policy year.

A chunk of the total return on an investment is through reinvested income so why lose return by suffering unnecessary taxation?

For some clients therefore, wrapping an OEIC in a bond wrapper is logical.

Capital Gains Tax

The CGT touch points for an individual holding an OEIC fund are highlighted above. Planning wise, the annual exempt amount of £12,000 in 2019/20 is fairly generous for many (non HNW) clients. Remember also the procedure for losses.

1. Current year losses – deductible from gains even if the net figure falls below £12,000. Excess carried forward.

2. Brought forward losses – if net gains in 1. above exceed £12,000 then deduct these losses just to £12,000. Excess carried forward.

Planning options with losses?

• Tax wise there is no point crystallising a loss when net gains in that same tax year are within the annual exemption.

• Losses crystallised in a tax year in which there are no gains will allow the full amount to be carried forward.

• If one spouse or civil partner has realised gains in excess of the annual exemption and the other spouse has uncrystallised losses, consider an exempt inter-spouse (outright) transfer followed by a subsequent disposal initiated by the recipient.

Where the gain is taxable, the part that falls within any remaining basic rate tax band is taxed at 10% the rest is at 20%. Any gains when the individual dies are wiped out.

• Spouse A has gains on an OEIC and assigns outright to spouse B who then dies.

• Whoever inherits the OEICs will acquire up at a new rebased value, with any gains having disappeared.

Regarding lifetime gains, the portfolio size and growth achieved will dictate whether clients can avoid CGT or not. Planning entails gains being crystallised within the annual exemption and repurchasing (mindful of the bed and breakfast rules).

In short, conditions exist where OEICs can be CGT free – in tax terms, again very nice.

There is a sting in the tail though.

Is it common to buy an OEIC fund and hold it until death? Remember that non spousal/ civil partner gifts trigger a CGT event. Is it common to remain invested in the same OEIC fund without switching? Attitude to risk and capacity for loss may change over time requiring a disposal.

Spare a thought for larger portfolios where it becomes increasingly difficult to manage gains within the annual exemption. At £500,000, a little over 2% growth will see you into CGT territory. Don’t forget also the possible income tax hit on those larger investments – even for holders of accumulation shares.

OEICs purchased within a bond wrapper resolve these issues and places the client in the chargeable event regime. Non spousal/civil partner gifts don’t trigger chargeable events. Likewise fund switches do not give rise to a taxable event. Gains aren’t wiped out on death though.

I’ll leave detailed scrutiny of bond chargeable-event taxation for another day, but in the meantime, in certain circumstances, wrapping an OEIC in a bond wrapper is logical, particularly large investment amounts for HNW clients.

Conclusion

It’s fortunate that financial planners have in their toolkit two products which are at either end of the investment spectrum – an OEIC which must produce income and a bond which is non income producing. Blending OEICs and bonds can place the client in the centre ground, slap bang in that sweet spot for tax purposes.

Wrappers delight indeed.