The M&G technical team compare and contrast trust planning with Business Relief for Inheritance Tax

It’s said there’s more than one way to skin a cat.

That’s certainly true when it comes to IHT where various planning stepping stones exist. This article focuses on just two of these planning options – lump sum gifting via trust planning or retaining wealth but investing in business property. In short, when it comes to wealth, give it away or hold onto it (in a tax efficient way of course). It’s an age-old dilemma, and to get us started, here’s the ground rules applying to both approaches.

Lump sum gifting (1) – Potentially Exempt Transfers (PETs)

Gifts of unlimited value become exempt (i.e. escape IHT) if the client survives for seven years. To put it another way, a PET is only chargeable if the client dies within seven years of making the gift. To qualify as a PET, the gift must be to another individual or to a specified trust such as a trust for a disabled person. Likewise, a gift to a Bare Trust will be a PET with the trust fund then falling inside the estate of the beneficiary.

What if death occurs within seven years of making a PET?

Tom makes a £340,000 PET and dies two years later with a death estate of £225,000. IHT is calculated in chronological order and so the £325,000 Nil Rate Band (NRB) is set against the PET. The excess of £15,000 is cumulated with the death estate to calculate total IHT due. IHT is charged at 40% on the cumulative total of £240,000 and the recipient of the PET is primarily liable for the tax due on the failed PET. No taper relief is due as the gift was made within three years of death.

PETs are straightforward, but their inflexibility and loss of control on how the gift is spent, means that caution should be exercised, particularly where large sums are involved. In saying that, many families are comfortable with PETs.

Lump sum gifting (2) – Chargeable Lifetime Transfers (CLTs)

Rather than inflexible PETs, clients can make CLTs into discretionary trusts where flexibility is in abundance. The trustees can accumulate income or pay it at their discretion, and normally they can pay out funds at their discretion to those within a wide class of beneficiaries (excluding the settlor). The beneficiaries don’t have any entitlement to the trust fund and therefore it doesn’t form part of their IHT estate. Due to this flexibility, discretionary trusts are potentially subject to an entry charge, a ten yearly charge and an exit charge. In saying that, depending on the numbers involved in a particular case, none of these charges might arise.

When gifting into a discretionary trust, clients must also take into consideration any previous CLTs made within the last seven years. PETs are not included in this cumulation. Providing this total doesn’t exceed the NRB there will be no entry charge. If the CLT exceeds the settlor’s available NRB there is an immediate charge of 20% on the excess, and If the settlor dies within seven years of making the CLT a further IHT charge may arise. If there are joint settlors who set up the trust equally it is effectively treated as two trusts settled by each settlor for IHT purposes. For example, if no CLTs made by both settlors in the previous seven years then double up the NRB.

Investing in Business Property

Business Property Relief (BPR) is a long standing IHT relief dating back to the 1970s when it was introduced to aid the intergenerational succession of the family business.

The 1984 IHT Act tells us that ‘business property’ includes any unquoted shares in a company, but shares don’t qualify if the business carried on by the company consists wholly or mainly of dealing in securities, stocks or shares, land or buildings or making or holding investments. In short, the company must be trading – otherwise investment activities could unfairly be sheltered from IHT. Another qualifying condition is that usually the shares must have been owned for at least two years.

Unquoted means not quoted on a recognised stock exchange with shares dealt on the Alternative Investment Market (AIM) being unquoted for these purposes.

For IHT purposes, it’s important for shares to be classed as business property so that if transferred, the value for IHT purposes is treated as reduced by 100%. Assume for example the shareholder dies – those shares will be included when calculating the value of the death estate, but a 100% deduction can then be available when calculating the value of the shares subject to IHT. It should be noted that the value of any business property is included in the estate for the purposes of assessing the loss of Residence Nil Rate Band where estates exceed £2m.

Clearly BPR is of interest to private business owners but more than that, it’s also of interest to IHT planners. In simple terms, if the deceased had cash in the bank of (say) £100,000 that will be included in the taxable IHT estate. If instead that £100,000 had comprised private trading company shares, and the two-year ownership period had been met, then the £100,000 shareholding would be valued, after BPR, at zero in the taxable IHT estate.

Incidentally, it’s no longer possible to reduce the value of an estate for IHT purposes by securing a loan on it where the loan is then used to acquire property qualifying for BPR.

Tina borrows £450,000 secured against her house and uses the funds to purchase AIM trading company shares. She dies five years later when the shares are worth £575,000. The rest of her estate is worth £1.5m. At the date of death, the debt reduces the value of the shares that can qualify for BPR from £575,000 to £125,000. BPR applies to that value

The total estate, including the AIM shares is £2,075,000 (£1.5m plus £575,000).

This is reduced by BPR of £125,000 and the liability of £450,000.

The value of the taxable estate is £1.5m.

The distinction between trust and BPR planning is clear, but for clients contemplating the pros and cons of lump sum trust planning as compared to investing in a BPR ‘arrangement’ then the questions below need addressed.

What if the client needs access?

- BPR

At first sight, this appears to be a no-brainer in favour of a BPR arrangement. The client doesn’t need to gift but simply retains ownership of the shares and therefore has access to the funds. But…

If the client is investing in private shares not listed on a stock exchange, and if he/she wants to encash, the withdrawal could take a period of time as encashments are funded by selling those private shares, and their value could be more volatile than listed shares. If a client wants to sell but no purchaser has been identified, then the company might need to step in and buy back its own shares and that process may lead to a greater delay than anticipated. Investments in AIM companies are however normally realised within a matter of days.

Clients in non-ISA BPR arrangements need to be aware that selling shares will trigger a disposal for Capital Gains Tax purposes and could result in a tax charge depending on personal tax circumstances. There is also a tax quirk to look out for where the (capital) gain can be taxed as income if the company which has been invested in, buys back the shares. In that case, no CGT exemption would be available, and the gain would be subject to income tax rates which are less favourable than CGT rates.

And don’t forget that selling shares reduces the BPR ‘pot’ as the proceeds then fall back into the taxable IHT estate.

- Trust

An outright gift into a Bare Trust will result in the property falling into the beneficial ownership of the recipient, and if the gift was into a Discretionary type Trust, then the settlor will be excluded from being a potential beneficiary to avoid gift with reservation problems. Therefore, whether the client sets up a Bare Trust or a Discretionary Trust, access to the trust fund seems problematic? Not necessarily so. Consider a Discounted Gift Trust (DGT) for those IHT planning clients who are unable to lose full access to their investment. In a DGT, access is typically provided by means of a series of pre-set capital payments to the client who is the settlor of the trust. DGTs don’t trigger the gift with reservation rules because the client’s rights are never given away and the client’s gift to the trustees is subject to the pre-selected payment stream, the right to which is retained.

Remember also that not all lump sum trust planning requires a seven-year gift. Take Loan Trusts, they’re for clients who want to carry out IHT planning but can’t give up access to their capital. Using a Loan Trust allows clients access to their original capital at any point and in any amount, but the growth will not be included in their estate for IHT purposes. For the avoidance of doubt, the outstanding loan remains in the client’s estate for IHT purposes.

Finally, on the question of access, many IHT planning clients are confident that they will require no access to the funds invested and therefore a simple gift trust, absolute or discretionary with no access to capital or growth will suffice.

Is the planning flexible?

- BPR

There is no gifting involved and so the investor can choose to retain, top-up, or encash whether partially or fully. Nice and flexible but remember that each new fresh investment will take two years to qualify. Another point to bear in mind is that for a deceased client, the shares must be held at time of death to qualify for relief. Perhaps the client feels ‘locked in’ regardless of investment performance? Clients fully or partially disposing of their BPR investment need to be mindful that those withdrawals fall back into the taxable estate. Depending on circumstances, those funds may then be given away as a PET or CLT but perhaps in retrospect the seven-year gifting clock could have started earlier?

- Trust

An outright gift is clearly inflexible – you can’t subsequently change your mind so choose recipients and amounts carefully! Also setting up a DGT is broadly inflexible as it will typically deliver fixed repayments to the settlor until he/she dies.

In contrast, consider an Insurance Bond in a discretionary gift trust. The client will have no personal access, but it can be topped up giving rise to a further CLT. Or it can be fully or partially encashed and funds can be distributed to beneficiaries at the discretion of the trustees without impacting on the client’s IHT position.

Consider also a loan trust where the outstanding loan balance remains inside the client’s estate. The client has the flexibility of reducing that by taking any amount (up to the original loan) at any time and spending it. Part repayments of the loan might be taken via 5% tax-deferred withdrawals. In addition, loan waivers are possible for those willing to reduce their outstanding loan and any amounts waived which are not exempt will either be a PET or a CLT depending on whether an Absolute or a Discretionary Loan Trust has been chosen. Check that the relevant insurance company provides a draft loan waiver deed for this purpose.

Are two years always better than seven?

- BPR

If a client dies, they must have owned the shares for the two years immediately before death. Where the deceased client had acquired the shares on the death of their spouse or civil partner then the client is deemed to have inherited the ownership period from their deceased spouse. It’s reasonable to conclude therefore that the minimum ownership with BPR is attractive.

- Trust

The seven-year clock applying to PETs and CLTs as described above is well understood and clearly can’t compete with a two-year qualifying period for BPR – but that two-year period is perhaps more vulnerable to future changes in tax law (see below). In addition, not all gifts are subject to the seven-year rule. If the normal expenditure out of income exemption applies, a gift is exempt regardless of whether the client survives for seven years, providing it meets three conditions.

- It formed part of the client’s normal expenditure

- It was made out of income (taking one year with another), and

- It left the client with enough income to maintain his/her normal standard of living.

This exemption could apply to a bond in trust scenario. An ‘income rich’ client places an insurance bond in a discretionary trust then uses the exemption to make further (exempt) gifts into trust to increment the bond. Rather than CLTs, the client would be making exempt gifts into a discretionary trust.

Not all lump sum trust planning requires a seven-year gift. Take Loan Trusts, they’re for clients who want to do IHT planning but can’t give up access to their capital. Using a Loan Trust allows clients access to their original capital at any point and in any amount, but the growth will not be included in their estate for IHT purposes. For the avoidance of doubt, the outstanding loan remains in the client’s estate for IHT purposes – even after seven years.

Finally, don’t forget that life insurance can be used to cover the two-year qualifying period for BPR purposes and the seven-year gifting period.

What about investment risk?

- BPR

The client’s capital is being invested in private or AIM listed trading companies. The value of shares in these companies can be more volatile than larger companies listed on the stock exchange. Clients can of course invest in a portfolio of companies. It’s also possible to encounter ‘schemes’ where the private trading companies are managed and run by the provider and the ‘BPR investors’ are the only shareholders. There may be a targeted non-guaranteed annual growth rate, but to meet these returns, the companies might need to borrow funds from external lenders and that might increase the risk of the client’s investment falling in value. Where private companies are involved the provider will have the responsibility of calculating the share price.

Diversification will clearly be limited. For example, an AIM ISA invested in (say) several dozen companies will be less diversified than a typical stocks and shares ISA. Likewise, as time passes a client’s attitude to risk may lower which raises the question of whether they should be invested wholly in smaller company equities.

Remember also that not all AIM companies qualify for BPR and some start off qualifying but later cease to do so.

- Trust

Clients implementing a bond in trust arrangement can enjoy the benefits of multi asset funds which spread the investment across a number of different types of assets. They can include a range of investment options such as company shares, fixed interest bonds, cash and property from both the UK and abroad. A choice of funds will be available to suit the risk/reward balance the trustees deem suitable to meet the trusts objectives and it’s also possible to access funds aiming to smooth the extreme short-term ups and down of markets.

Should I plan now or later?

- BPR

From an IHT perspective, successful BPR planning typically requires the investor to hold the shares for at least two years, retain them until death, and for the company shares to qualify for BPR at that time. Rather than plan early, this might lead clients to a plan later approach which isn’t necessarily a good thing.

- Trust

In contrast, clients who are planning to mitigate IHT by gifting are likely to adopt a planning now approach to start that seven-year clock running as soon as possible. The merit of this approach is that the investor is incentivised to act now. The benefit of planning now? It can take place in a known environment i.e. tried and tested under current tax rules. Also, many clients like to gift now to enjoy seeing their family benefit. Delayed planning can prevent that, and those clients may also be at the mercy of future tax measures which unfortunately have the habit of being less benign than current rules.

What if tax rules change?

- BPR

A change in tax rules is potentially problematic. Consider for example a client who has held shares qualifying for BPR for a number of years. Assume now that IHT rules change, and these shares no longer qualify for BPR. That long running period of ownership might then account for nothing. What if the client experiences an adverse change in tax rules and seeks to encash? IHT planning might then be challenging depending on the age and health of the client and there could be a Power of Attorney in place severely restricting IHT planning options. From a planning perspective, valuable time will have been lost. Also, if tax rules were to change adversely then in a particular BPR scheme, there might be a significant number of shareholder disinvestments requiring share buybacks. If the underlying companies do not readily have the cash funds available, then that buy back process could take much longer than anticipated.

- Trust

Clients who have made gifts outright or into trust are unlikely to have that planning disturbed by a change of tax rules – that would be retrospective legislation.

I’ve been appointed attorney/guardian, are these planning options available to me?

- BPR

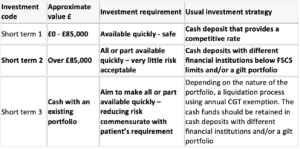

Those acting as someone’s attorney or deputy must make any decisions based on the person’s beliefs and best interests (not their own). In the case of Buckley v The Public Guardian*, Senior Judge Lush stated that, when investing, attorneys like trustees, should exercise such skill and care as is reasonable in the circumstances, and ensure that the investment is suitable. Judge Lush commented that two of the most important factors when considering the suitability of investments are the donor’s age and life expectancy. In the judge’s opinion, short term investment ‘codes’ are generally more important where a donor has an anticipated life expectancy of five years or less (previous guidance suggested that without clear evidence it would be prudent to consider a life expectancy of less than five years for new patients aged 80 or over. The Judge suggested short term investment codes could be set out as follows.

In the Buckley case, Senior Judge Lush had no need to consider long term investments but clearly BPR investments do not sit within the above short term investment strategy. For longer term investments the Trustee Act 2000 requirements provide a good yardstick as does the judge’s statement that “Managing your own money is one thing. Managing someone else’s money is an entirely different matter.”

Finally, should the interests of beneficiaries under the will or intestacy of the donor be considered (e.g. an IHT friendly investment might be in their interests)? Earlier guidance concluded that it will probably only be worthwhile to consider in depth the interests of those who will benefit on death if the following conditions all apply

- The capital available for investment is over £100,000 (per that earlier guidance).

- There is no reason to believe that the ‘patient’s’ state of health is life-threatening, and

- The capital when invested will adequately satisfy the patient’s current and future income and capital requirements

*[2013] CoP Case 12228697

A few other points to consider:

If the primary purpose is to save IHT the benefit to the donor may be unclear.

Does the donor have a history of investments with a similar risk profile and would the investment be considered if IHT planning was not required?

There may be a conflict of interest if the attorney is a beneficiary of the donor’s estate.

So, where IHT planning is not allowed, then business property would only be considered for its intrinsic investment value which may be a high bar for those with fiduciary investment duties.

- Trust

As a rule of thumb, lump sum trust planning by Attorneys and Guardians isn’t permitted. Unless the paperwork says otherwise, an attorney or deputy can only make a gift if it’s either

– to a family member, friend or acquaintance of the person on a ‘customary occasion’, or

– to a charity that the person might have given to if they had mental capacity

In both cases, it is essential the gift is of reasonable value given the size of the person’s estate. If an attorney or deputy wishes to increase the limits on the gifts which can be made, then application must be made to the Court of Protection.

From a financial planning perspective, common insurance company trust arrangements (including loan trusts) will all give rise to a gift.

In Scotland, it’s possible to create a continuing power of attorney over property and financial affairs which includes powers for the attorney to make gifts, and desired limits can be imposed on the size of such gifts or the potential recipients.

Conclusion

In principle, there is no right or wrong answer when it comes to trust or BPR planning. Instead, it’s important to recognise that both have their place, depending on the circumstances, and it may be that a blended approach will work for a given scenario. That makes sense as lump sum trust gifting impacts the NRB but BPR planning doesn’t.