When it comes to making gifts, there is an ideal order in which to do this, says Julia Peake, Technical Manager, Nucleus Financial.

The ideal order of gifting is:

Why?

Firstly, Wills should be on the top of most people’s lists to ensure they have one and it is up to date. It gives clients control and comfort that when they die, their appointed legal personal representative (executors) will deal with their wealth, possessions, and assets how they want them dealt with.

Next would be Loan trusts or Gift and Loan trusts, as the money is loaned, (usually interest free) rather than gifted to the trustees. If it is a Gift and Loan, the £10 gift is usually covered by an exemption but if not, this will be a Potentially Exempt Transfer (PET) or Chargeable Lifetime Transfer (CLT) depending on the type of trust. The Settlor/ Donor can recall the loan back at any time but should be mindful of tax consequences depending on the underlying asset. The Settlor/ Donor can waive their outstanding loan making it a gift to trustees/another person. Depending on the type of trust this might be a PET or CLT and there could be tax and reporting consequences if the gift is over the available nil rate band (NRB).

The loan will remain inside the estate of Donor/Settlor, but growth will be outside from day 1. Provisions should be made in the Will as to how any outstanding loan should be dealt with on the Settlor’s/Donor’s death.

Exempt Gifts should be considered next. These include gifts to:

- Spouses and civil partners

- Registered charities and registered clubs

- Political parties

- Housing associations

- The national purpose to the listed organisations in the IHT Manual

- The public benefit/ Heritage/Maintenance fund

Also:

- £3,000 annual allowance. If you have not used the previous years, then this could be £6,000 or £12,000 combined for spouses and civil partners.

- Small gifts of £250 to as many people you like so long as it is not the same people who have benefitted from your annual allowance.

- People getting married, the amount will depend on your relationship:

- Per Parent- £5,000

- Per Grandparent- £2,500

- Anyone else -£1,000

- Gifts out of normal expenditure out of income means gifts made from excess income will be exempt subject to meeting all the conditions. These are that it should be from income, normal for that person (considering the nature of the gift, frequency, value of the gift) and that it should not negatively impact the person’s standard of living.

Chargeable Lifetime Transfers (CLTs) to discretionary or interest in possession trusts come next. These gifts use the NRB and remain inside the estate for 7 years. Cumulative gifts more than the available NRB will be subject to an entry charge as well as being inside the estate for seven years, with growth outside from day one.

These types of trusts are also subject to a 10-year principal charge as well as exit charges when the trustees distribute to the beneficiaries. Trustees will also need to consider all reporting requirements including the Trust Registration Service (TRS) if applicable.

Potentially Exempt Transfers (PETs), outright gifts to individuals, or gifts to absolute trusts or trusts for disabled persons would be last. These gifts don’t use up the nil rate band but will remain in the estate for seven years, with growth outside from day one.

PETs are completed after the CLTs as a failed PET (a gift where the individual dies within 7 years) can impact the principal charge calculation that needs to be completed every 10 years for relevant property trusts as well as any new discretionary trusts. This is because if the PET is made first and then becomes chargeable due to death within 7 years, it uses up the NRB first. So can affect the NRB available to set against the value of the trust when doing principal charge calculations on the 10th anniversary of the relevant property trust or the available NRB for making gifts to trusts going forward.

However, when making CLTs and PETs, a full seven years should be left between them, or the 14 year shadow could apply. Let’s have a look at an example below.

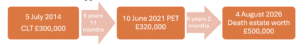

Client A makes the following gifts:

The nil rate band when they die is £325,000. For Client A on death, the 2014 gift of £300,000 is excluded and the 2021 PET becomes chargeable and first into the IHT calculation.

IHT calculation

£320,000 x 0% = £0

£5,000 x 0% = £0

£495,000 x 40 % = £198,000 IHT on estate

Client B makes the following gifts:

The nil rate band is again £325,000. For Client B however, we need to consider the tax on the failed PET made in June 2021 and this is where the 14 year shadow comes in. When calculating tax on lifetime gifts that fail (PETs and CLTs) you look back 7 years from the failed gift to see if there are any chargeable transfers sitting in that 7 year window.

While the CLT in 2014 isn’t included in the IHT calculation, it is first into the calculation when calculating the tax payable on the failed PET and as death occurs between years 6-7 then gift taper relief applies.

PET tax calculation

£300,000 (CLT from 2014) x 0% = £0

£25,000 x 0% = £0

£295,000 x 40% x 20% = £23,600- which is Payable by beneficiary

Plus £198,000 IHT payable on estate.

Estate planning and making lifetime gifts should be part of every client meeting, especially with the changes announced in the recent Budget. Ensuring this is done correctly and the timing of these can be vital to supporting the client’s holistic plans and allowing them to reach their financial goals.

Main image: chris-niwore-_pK-fP_SuL4-unsplash