In this latest article, the Aberdeen technical team look sat the benefits to pensions saving offered by salary sacrifice and ponders the potential changes to the tax relief offered.

Salary sacrifice is a fantastic way to boost employees’ pension as both the employee and employer NI savings can increase the amount to be saved. With employer NI having risen from 13.8% to 15% from 6 April it has seen a spike in the number of enquiries from employers.

Salary sacrifice is largely the domain of workplace pensions. However, it is worth remembering that advised clients can also request that their employer pays the contribution into their own SIPP or personal pension. If the employer agrees it can be a great way to bring all a client’s assets under advice, making ongoing management and reviews easier.

But these increased NI savings have also piqued the interest of HMRC. Research published in May considered hypothetical changes to the tax relief that salary sacrifice offers. This has fuelled speculation that changes could be coming. However, whether any changes will materialise remains uncertain.

How does salary sacrifice work?

Salary sacrifice is a way for employers to improve the benefits on offer to employees by boosting their retirement savings. This is achieved by giving up pay under a contractual agreement in exchange for an employer pension contribution. The primary advantage for salary sacrifice is the employee and employer NI savings on the salary sacrificed. Some employers may pass on some, or all, of their NI savings as an incentive to employees. Employers are not obliged to offer salary sacrifice arrangements.

Salary sacrifice into a SIPP

Salary sacrifice into a SIPP could be a very attractive option for employed business owners, company directors and even higher earning employees wishing to make additional savings on top of their employer’s scheme. They may even want to opt-out of the employer scheme if the employer agrees to divert their contribution to their chosen SIPP. Employees simply need to ask their employer to direct the payments into their chosen SIPP. The employer can approve or decline the request. If they agree to the arrangement they will need the relevant payment details of the receiving SIPP.

Making an additional contribution via salary sacrifice into a SIPP will offer greater investment choice and freedom, access to discretionary fund managers, a contract that is “retirement ready” for those wishing to use flexi-access drawdown, as well as ongoing advice and reviews with their financial adviser.

Example

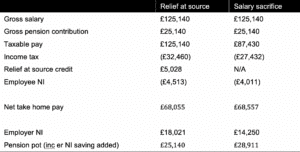

Jessica is a director of a trading company and takes a salary of £125,140. She is also in her employer’s group pension scheme but makes no personal contributions. She is planning to make an additional gross pension contribution of £25,140 to her SIPP to reduce her adjusted net income to £100,000 and so reinstate her full personal allowance.

This can be achieved by making a personal contribution by the ‘relief at source’ method or by using salary sacrifice. Under salary sacrifice, her employer has agreed to add their full NI savings to the employer contribution generated.

By choosing the salary sacrifice route, Jessica has increased her take home pay by £502, with an extra £3,771 saved into her pension – an increase of 15%.

Disadvantages of salary sacrifice

Whilst salary sacrifice offers clear financial incentives for both employer and employee, there are some disadvantages which need to be carefully considered:

• As the arrangement is contractual, the employer would have to agree to any changes to the salary sacrificed. This may be limited to only making changes at the start of the business year or at a significant life event.

• The employee’s ability to borrow could be limited to their reduced salary

• Other employment benefits such as death in service or PHI could be based on the reduced salary

• Entitlement to earnings related state benefits, such as statutory maternity pay, statutory sick pay, means tested benefits, tax credits and state pension accrual could be affected by the reduced salary

• There could be an impact on the calculation of threshold income for a tapered annual allowance calculation.

HMRC research on salary sacrifice

On 27 May 2025, HMRC published research on salary sacrifice for pensions that was undertaken in 2023, suggesting that these arrangements could be under the spotlight for review.

The research looked at employer mindsets towards salary sacrifice and their views on three hypothetical scenarios, each with a different tax treatment of salary sacrifice arrangements:

1. Removing the NI relief for employer and employee salary sacrificed pension contributions

2. Removing the NI relief for employer and employee salary sacrificed contributions and removing the income tax exemption for employees on the salary sacrificed

3. Removing the NI relief for employer and employee salary sacrificed contributions above a £2,000 annual threshold.

Going back to the example of Jessica, sacrificing £25,140 of her £125,140 pay, the three scenarios would have the following effect:

The hypothetical scenarios were generally met with negative responses, with employers outlining the effect on employee morale, the administrative burden and how it could change their pension offering in the future.

Without the NI savings, Scenario 1 would put both the employee and the employer in the same position as making the pension contribution under either a net pay or a relief at source scheme.

Option 2 was met with the most negativity; effectively rendering salary sacrifice redundant as it becomes a more expensive option for both employees and employers than a net pay scheme.

Option 3 was the most favourable of the scenarios, although employers still highlighted the additional operational costs of operating a tiered system.

What’s next for salary sacrifice?

Salary sacrifice arrangements set up after 8 July 2015 are included in the calculation for threshold income for tapered annual allowance calculations. Arrangements in place prior to this date are ignored when establishing threshold income.

If changes are made to the NI and tax relief available on salary sacrifice arrangements, the government could take a similar stance and introduce it for new salary sacrifice arrangements set up after a particular date.

Whether there will be any future reforms is uncertain. Any changes introduced could be retrospective, affecting all salary sacrifice arrangements. The publication of this research may be an indication of changes ahead, but whether any of these ideas will be implemented remains to be seen.

Salary sacrifice arrangements can be changed when certain lifestyle events occur, such as getting married, starting a family, or adjusting pension funding after a divorce and pension sharing order. Amending the terms whenever you want outside of these events could risk invalidating any benefits of salary sacrifice.

Main image: paul-green-mln2ExJIkfc-unsplas