Onshore or offshore bonds? That is the question. Graeme Robb, Senior Technical Manager, Specialist Business Support, M&G, provides some clarity.

UK life fund taxation is a highly complex topic. Let’s see if we can bring that complexity down a bit!

HMRC’s Insurance Policy Taxation Manual tells us that:

“The general rule is that an individual or trustee who is liable for tax under the chargeable event regime is treated as having paid tax at the basic rate on the amount of the gain.”

We colloquially refer to this as the 20% UK Bond tax credit.

The consequence of the above is that chargeable event gains on UK bonds are not liable to basic rate tax. The individual (or trustee) who is liable for tax under the chargeable event regime is treated as having paid tax at the basic rate on the amount of the gain. This reflects the fact that the funds underlying a UK policy are subject to UK life fund taxation.

Investment income received by the life fund is taxed at 20% – given the comments above, that’s logical. Less intuitively perhaps, UK and overseas dividends received within the life fund are tax exempt which drives down the effective tax rate to below 20%. But the tax credit stays at 20%! A nice bonus for the investor.

What about capital gains within the fund? These are taxed within the life fund at ‘up to’ 20%. When the fund makes a capital gain on certain long term assets, then indexation allowance may apply up to December 2017. Indexation allowance strips out inflationary aspects of the gain and also helps drive down the effective rate below 20%. Another nice bonus for a bond investor.

This is good news for the investor but how can an offshore bond compete with an onshore bond for a UK resident especially if the policyholder has no plans to encash in an overseas low tax jurisdiction?

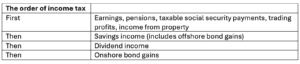

One answer is that with an offshore bond, where the UK policyholder encashing is on a low income, then it’s possible to enjoy tax free gains up to £18,570. Let’s see that in practice. The order of income tax is a good place to start.

With this in mind, let’s see how an offshore bond gain can sometimes be sheltered by otherwise unused personal tax ‘allowances’. For illustration purposes, assume the client has zero income and an offshore bond gain of £18,570.

The first £12,570 of gain is absorbed by the otherwise unused personal allowance.

Then £5,000 of savings income can be taxed at zero thanks to the starting rate for savings.

Offshore bond gains are taxed as savings income (see the order of tax rules above). This fact can unlock access to the £5,000 0% starting rate for savings. This can be confusing so it’s important to understand how the savings rate works. Here goes…

- The starting rate for savings applies to savings income only. That’s not surprising!

- If a client’s taxable non-savings income (e.g. pension or earned income) exceeds the starting rate limit, then the 0% starting rate for savings is not available.

- Non-savings income (but not dividends) takes priority over savings income in a tax calculation and therefore the 0% starting rate is not available where non savings income exceeds the personal allowance plus £5,000.

Note that £12,570 + £5,000 totals £17,570 and so we still potentially have a further £1,000 of allowance to consider. This relates to the tax free personal savings ‘allowance’ (PSA) of £1,000. The amount of PSA depends on adjusted net income. Up to £50,270 the PSA is £1,000, then £500 up to £125,140, then zero. The use of the word ‘allowance’ is misleading as it is, in fact, a zero rate tax band. For the record, adjusted net income is total taxable income before any personal allowances and less certain deductions such as gross gift aid payments and gross relief at source pension contributions.

Think of an offshore bond funded by grandparents. It’s possible for the grandchildren to enjoy tax free offshore bond gains. For example encashment gains taxable on student grandchildren and also those still at school who beneficially own offshore bond segments which were either assigned to them or irrevocably appointed to them under bare trust. At the other end of the age spectrum, consider gains falling on retirees who can flex their income possibly down to zero.

Taking advantage of the various allowances within the tax system can reap rewards …and it’s often not that complicated.