When mitigating Inheritance Tax, are we making the most of the tools at our disposal? asks Julia Peake, Technical Manager, Nucleus Financial.

HMRC recently published their annual Inheritance Tax liability statistics showing data from tax year 2021-2022, relating to the composition of estates, the use of reliefs, the tax due on estates and information on trusts paying IHT trust charges.

The release showed 4.39% of UK deaths resulted in an Inheritance Tax (IHT) charge, an increase of 0.66% compared to the previous tax year meaning, IHT is payable on fewer than 1 in 20 estates.[1] It still might be negated further by working with financial services, tax, and legal experts to build considered holistic financial plan.

While creating a tax efficient plan will be personalised to an individual’s wants and needs, some of the information in the report did raise some questions:

- Are exemptions being utilised to provide maximum tax efficiencies?

- Why are the number of taxable trusts reducing?

Exemptions and reliefs

There are certain exemptions and reliefs that most people will be able to claim to help reduce their taxable estate either during your lifetime or on death.

Death and Lifetime

- Spouse/civil partner exemption , though gifts to non-UK domiciled spouse exempt up to a total of £325,000

- The value of exempted transfers to qualifying charities also increased, to £2.1 billion in the tax year 2021 to 2022 from £1.8 billion in the tax year 2020 to 2021[2]

- Standard nil rate band for lifetime gifting and on death when the unused percentage can be transferred to the surviving spouse/ registered civil partner, which can be utilised on

- The recent statistics show the largest exemption used is transfers between spouses and civil partners, valued at £15.5 billion in the 2021 to 2022 tax year and used by 21,800 estates. This exemption was used by 34% of estates with assets above the NRB but was worth 68% of the total value of reliefs and exemptions set against assets.[3]

Lifetime only

- Annual exemption £3,000, which can be carried forward one year but must use current year first.

- £250 Small gift exemption to as many people you wish so long as it is not combined with the annual exemption.

- Marriage exemptions, which can be combined with the annual exemption

- £5,000 from each parent plus

- £2,500 from each grandparents plus

- £1,000 anyone else

- Gifts out of normal expenditure- one of the most under used exemptions, which can offer some of the best savings subject to the requirements being met. It is essential that good records of gifts made, and income and the sources are kept for the personal representatives to claim on death.

Death only

- Residence nil rate band (RNRB)- subject to qualifying criteria and also this can be transferred between spouses and registered civil partners, which can be utilised on the second death.

- Assets subject to business relief (BR) and agricultural relief (AR).

The statistics show that in the tax year 2021 to 2022, 25,800 estates used the RNRB threshold, equating to a £6.5 billion saving for individuals, an increase of £0.4 billion compared to the tax year 2020 to 2021.[4]

Additionally, after the transferable NRB, the second largest relief set against assets was BR, valued at £2.9 billion and used by 4,170 estates followed by AR valued at £1.6 billion and being claimed by 1,730 estates.[5]

We also need to be mindful of the upcoming Budget at the end of October and the rumours around potential changes to BR and AR assets and the impact this might have on individuals’ plans. We need to be ready and willing to speak to clients about the potential to make changes to their underlying assets to ensure they can achieve their financial goals.

Trusts

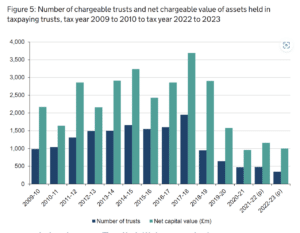

IHT receipts from relevant property trusts has reduced over the years due to a number of different reasons. Some trusts come to a natural end, some keep the values below the prevailing nil rate band so not to suffer entry or exit charges for the 10 years. Some will do Rysaffe planning during the lifetime so multiple trusts set up on consecutive days spread the money so each trust will have its own nil rate band on the 10th anniversary.

The below show the number of taxable trusts is reducing but the number of trusts registered on TRS has increased significantly due to legislative changes. Also, receipts from income tax and capital gains tax have risen and this might be due to the changes in the capital gains tax exemption over the past couple of years.

Source: Inheritance Tax liabilities statistics: commentary – GOV.UK (www.gov.uk)

Trusts are fundamental part of a client’s financial plan and while many use them for estate planning reasons, the essence of a trust is about control and having piece of mind that you can decide who you want and importantly who you don’t want, to benefit from your wealth. They can also help provide for family, minors and those who may not have the capacity to deal with their own affairs. They can remove assets from the scope of probate which can really assist the personal representatives when they are dealing with the estate.

When speaking to clients about mitigating their potential to IHT, we need to make sure we are making use of the tools in our toolbox to help construct a financial plan which ensures the clients can meet their investment ambitions.

Utilising reliefs, exemptions and trusts are a key part of this as well as ensuring we can pivot with changes in legislation and regulations.

[1] Inheritance Tax liabilities statistics: commentary – GOV.UK (www.gov.uk)

[2] Inheritance Tax liabilities statistics: commentary – GOV.UK (www.gov.uk)

[3] Inheritance Tax liabilities statistics: commentary – GOV.UK (www.gov.uk)

[4] Inheritance Tax liabilities statistics: commentary – GOV.UK (www.gov.uk)

[5] Inheritance Tax liabilities statistics: commentary – GOV.UK (www.gov.uk)