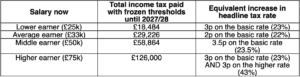

The extended freeze on income tax thresholds will see some workers’ tax bills rise to the equivalent of 23.5%, new analysis by AJ Bell has shown.

Someone on a salary of £50,000 will pay just under £59,000 in income tax over the course of the six year threshold freeze. According to AJ Bell, the total tax bill is more than £9,000 higher than it would be if the tax thresholds were instead uprated with inflation during that time.

The tax specialist said that if the government had chosen to increase the headline level rate of taxation, rather than implement a “tax hike by stealth”, the basic rate would need to have risen to 23.5% from this year to generate the same total tax bill for someone earning £50,000.

Middle earners will be particularly affected by the stealth tax, as they run the risk of being pulled into a higher tax band. However, lower earners will also be impacted by the freeze in personal allowance. Someone on the average UK salary of £33,000 will be subject to the equivalent of an increase in the basic-rate of income tax to 22%.

Meanwhile, higher earners with a £75,000 annual income will be hit by the equivalent of both the basic-rate and higher-rate of tax increasing by 3% to 23% and 43% respectively.

Laura Suter, head of personal finance at AJ Bell, said: “These figures lay bare just how much the decision to freeze tax allowances will cost taxpayers over the six years of the freeze. They also highlight the sneaky tactics employed by the Government to nab more money from our pay packets without many taxpayers realizing.

“Imagine the uproar and headlines if the Government had increased the basic rate of tax from 20% up to 23.5%. Not least because it would break a manifesto commitment. But, more importantly for voters, it would be much easier for them to understand the scale of the huge hike in their tax bill in the next few years.”

Suter said the government has relied upon most taxpayers not understanding how ‘fiscal drag’ works and said that unless the Government significantly hikes tax thresholds in 2028, the impact will continue for the rest of people’s working lives.

Suter added: “Each taxpayer is impacted differently depending on their pay, so the equivalent tax rate increase varies across income levels. But once again the ‘squeezed middle’ are hit hardest, with the impact of the frozen allowances meaning those with salaries near the current higher-rate threshold are squeezed on both sides, getting less of their income tax free and seeing more of their income pushed into the higher-rate band. The result is the same as if thresholds were instead uprated to keep them out of the higher rate tax band, but the basic rate were increased to a whopping 23.5%.”

Source: AJ Bell. Median UK salary is £33k, based on ONS April ’22 figures. All salaries are uprated with average wage inflation in line with the latest OBR forecast. Analysis compares the total income tax bill from 2022/23 tax year to the end of the 2027/28 tax year. Equivalent increase in the headline tax rate is the % rate of income tax (rounded to the nearest 0.5%) each individual would need to have paid to generate the same level of tax had thresholds instead been aligned to inflation.