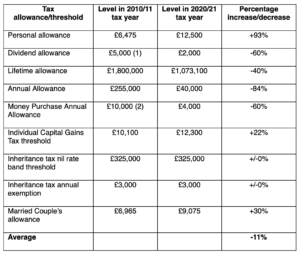

Tax allowances and thresholds have fallen by 11% over the past decade and are set to decrease further as the Chancellor looks to balance the books in the wake of the Covid-19 pandemic, so clients should ensure they use their allowances before they reset in April.

Research by Quilter found that while the personal allowance has risen by 93% over the last 10 years, it has come with huge cuts to pension allowances and a freezing of the inheritance tax nil rate band.

The pension annual allowance has been reduced by 84%, while the lifetime allowance has dropped by 40%. Similarly, both the dividend allowance and money purchase annual allowance have also seen reductions of 60%.

Inheritance tax has also failed to escape unscathed, with the nil rate band remaining frozen since 2009.

As the end of tax year approaches, Quilter has warned that clients must make use of their allowances as many will now be frozen as a result of the pandemic and risk getting worse over time.

Rachael Griffin, tax and financial planning expert, Quilter, said: “The various tax allowances and thresholds are great ways to incentivise people to save for their future, distribute their wealth and help establish a strong financial future. However, many of these have taken huge hits in recent years as subsequent governments look to claw back as much tax as possible.

Rachael Griffin, tax and financial planning expert, Quilter, said: “The various tax allowances and thresholds are great ways to incentivise people to save for their future, distribute their wealth and help establish a strong financial future. However, many of these have taken huge hits in recent years as subsequent governments look to claw back as much tax as possible.

“One could argue that these allowances and thresholds are never going to be as good again and will only get worse from here. The Chancellor recently outlined plans to freeze many of these tax allowances in order to start balancing the books to help pay for the pandemic response.”

Griffin said it was vital individuals utilise their tax allowances as much as they can before they reset in April, rather than take a wait and see approach.

Griffin added: “It is also worth remembering that many of these allowances have failed to keep up with inflation. Expectations are that inflation is going to rise as the economy reopens, so this will effectively decrease the levels in real terms over time. Putting money into a pension or gifting it to a family member now could make a real difference compared to waiting for the next tax year.”

1. Dividend allowance was introduced in the 2016/17 tax year

2. Money Purchase Annual Allowance was introduced in the 2015/16 tax year