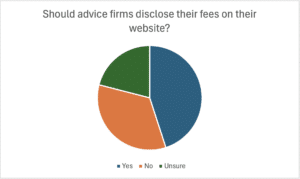

Almost half (45%) of paraplanners believe firms should disclose their fees on their website, but less than a fifth (17%) do so, the findings from Professional Paraplanner’s Parameters Survey have revealed.

Openness and transparency were cited as key reasons for disclosing fees, with paraplanners acknowledging that it would help potential clients to understand the costs involved.

“It would allow customers to check before they approach a financial adviser and allow them to be able to compare what firms provide and what the customer will get from the fees charged,” one paraplanner explained.

Another paraplanner said disclosing fees would provide better client outcomes “as clients could more easily compare value.”

However, a third (34%) of respondents disagreed with firms putting fees online, with the vast majority citing different client needs. There was a clear concern that fee structures could be difficult for clients to understand and could change according to a client’s individual circumstances.

“It would be false to say we charge X but in actual fact, after the initial meeting and factfinding, it will be Y,” one paraplanner said.

Others echoed the sentiment, with one pointing out that it would be “impractical” to list all various scenarios and circumstances with their accompanying fees on the website, while another cautioned that not all fees can be shown in a clear way and “there are times when fees may be amended in which case clients could claim we weren’t being fair.”

As one paraplanner explained: “It’s a difficult subject to cover because we don’t sell a simple product. There is a chance that a client may come to us with a specific problem and we end up identifying other things so it’s difficult to price things up before you have a good understanding of a client’s needs.”

The issue of competition also emerged, with paraplanners admitting that publishing fees on the website could end up being a ‘race to the bottom’ without being fully representative of the value a firm could offer clients.

The issue of clients being put off by what they consider expensive fees was also a key theme, amid concern that it could discourage them from seeking advice altogether or not choosing a firm that would be a good fit for them in favour of a cheaper option.

“Fees are often not comparable as the service received for the cost can vary hugely between firms. I suspect this would result in clients going with the often cheaper big players and ending up disappointed and jaded in the resultant experience,” one respondent said. “Smaller independent firms are sold on their personal touch and this cannot be effectively understood by potential clients through the website.”

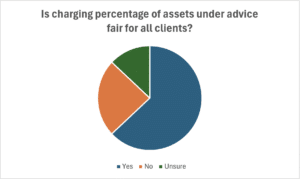

Assets under management percentage fee – a fair system?

Nearly two thirds (63%) of those surveyed said they believe charging percentage of assets under advice is fair for all clients, even if clients with larger AUM receive a discounted rate over certain figures. This compares with just 24% who do not believe it is a fair system. A further 13% said they were unsure.

One paraplanner commented: “Firms will be rewarded for good performance of investments through growth of the fund and therefore additional fee income, whereas poor performance sees fee income reduced.”

Paraplanners pointed out that clients with larger AUM often have more complex needs and there is a greater liability if anything goes wrong.

“Clients with greater AUM have greater planning needs, therefore from our firm’s point of view, they may need more frequent contact and have the need to monitor CGT allowances or pension allowances much more closely,” one said.

There was also the suggestion that a fixed fee structure can be “disproportionately unfair” to smaller clients.

According to one respondent, it could be difficult for smaller firms to manage operationally if the system moved to billable hours or a set annual charge.

However, others deemed the model unfair, stating that clients should not be expected to pay double for the same service as someone else and instead ongoing fees should be based around the work undertaken, the complexities and the time taken rather than the level of AUM.

“I think it needs reviewing regularly but there is a lot of work and expense in the background which has to be covered,” one paraplanner told Professional Paraplanner. “We try to act in a fair manner to all our clients and treat them equally when we can, although some clients are paying less than it costs to look after them and some are paying a large amount but don’t necessarily make us work as hard for their money.”

Another said: “I firmly believe we should be charging by the hour, with perhaps a retainer applied across AUM that is proportional to the service level the client receives.”

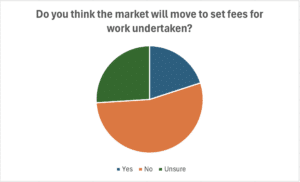

Looking ahead, only a fifth (20%) of clients believe the market in general will move from a percentage of assets under advice to set fees for work undertaken. This compares to 54% who do not expect such a shift. A quarter (26%) of respondents said they were unsure.

While those in favour said such a system is “the only fair way to charge,” others said many firms would struggle to move to such a charging model.

“There is a danger that it might happen but that will make the advice gap balloon,” one commentator explained. “The additional admin work for charging fixed fees will price people out and fixed fees only really work for the large accounts.”

Others said a mix of the two models may emerge, with a fixed fee applied to planning and transactional advice, and a percentage model used for portfolio management.

“Up front fees can often put a client off as they may see it as an expense that they cannot justify, whereas a percentage fee prevents this attitude and allows a client to see that their advice is already paid for. A mixture of both would probably work going forward and would precent scenarios like adviser firms having to return ongoing fees to a customer.”

However, it was evident that many did not believe change would take place unless the FCA mandate it.

“There’s currently no incentive for financial advisers to move to fixed fees. Why would they deliberately stunt their own growth and earnings potential? I do, however, think that a few more advisers will gradually start to charge fixed fees for things – particularly to try and capture clients that would otherwise go with a ‘direct to client’ offering, or just require simple, one-off advice,” one paraplanner added.

Main image: julia-taubitz-kiVciIFK3xI-unsplash