Data shows that individuals may not be making full use of scheme pays or are simply not aware they can do so. Danielle Byrne, technical consultant at AJ Bell looks at how scheme pays works in relation to the annual allowance

After hitting its peak in 2011 the annual allowance has been reduced on multiple occasions and in several ways. Ignoring carry forward, £40,000 is now the maximum most can contribute without being hit with a tax charge. According to HMRC in 2006/07 only 140 individuals exceeded their annual allowance, with the total value of excess pension contributions amounting to £2m.

A decade later the comparison is staggering. In 2016/17, 16,590 individuals reported exceeding their annual allowance with excess pension contributions amounting to £517m. There’s no doubt the reduction in allowance and the introduction of the money purchase and dreaded tapered annual allowance will be the reason for the spike in numbers.

It’s interesting the figures do not show a proportionate increase in the number of charges paid by the pension scheme. For 2016/17 a mere 2,340 were paid by schemes, whereas 16,590 were paid by self-assessment. This indicates individuals may not be making full use of scheme pays (and voluntary scheme pays) or are simply not aware they can do so.

Whether they pay the charge personally or through their pension scheme, it is the member’s responsibility to notify HMRC and they must do so by completing a self-assessment tax return.

Scheme Pays

To qualify for scheme pays the member’s charge for the tax year must exceed £2,000 and the amount contributed, in the same tax year, has to exceed the annual allowance of £40,000. Scheme pays cannot automatically be used if the client has simply exceeded the MPAA or TAA. If the conditions are met and the scheme is notified by the deadlines then the scheme will become jointly liable with the member for paying the charge.

The most important date to remember here is 31 July in the tax year two years after the tax year to which the charge relates. This is the date by which the member must notify the scheme for joint liability to apply. For example, a charge relating to the 2019/20 tax year the scheme must be notified by 31 July 2021. Once the notification has been submitted after meeting the conditions, the member cannot change their mind and withdraw the notice.

If the client is in the process of transferring from one provider to another they can require the new provider to pay the charge providing the notification deadline is met.

Voluntary Scheme Pays

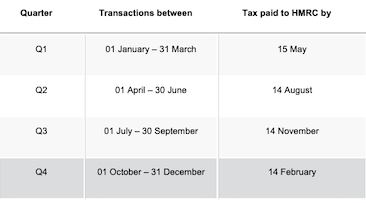

As the name suggests the charge is paid on a voluntary basis. Because of this the scheme does not become jointly liable and the responsibility lies with the member. The charge must be paid by the member’s self-assessment deadline of 31 January to avoid tax charges. This can present practical issues for the scheme administrator in making the payment to HMRC as they do this via the accounting for tax return (AFT). AFT is completed quarterly within the timeframes set out below:

The only way to guarantee the payment reaches HMRC by the member’s self-assessment deadline of 31 January would be to ensure it is accounted for within quarter 3. The member may just be lucky if the scheme administrator chooses to report earlier than the deadline within quarter 4 but technically they have until 14 February. If the self-assessment deadline is missed the member may incur a late payment charge.

Defined Benefit (DB) v Defined Contribution (DC)

Scheme pays may bring welcome relief to some as they don’t have to find the cash to pay the charge personally. It’s important to remember for DC schemes the individual’s pension scheme is being reduced at the point the charge is paid. As a result they’re giving up any growth had the funds stayed in the scheme until retirement.

It can prove even more costly for DB scheme members as they effectively take a loan from the scheme which has to be repaid with interest when the member takes benefits or transfers to another provider. This means younger members could be hit particularly hard, as they could have a larger amount of accrued interest. To avoid this, if the charge arises within a DB scheme it may be possible to pay it via a separate DC scheme (if available and permitted) using voluntary scheme pays.

Shortly before 6 October, this year’s pension savings statements will be sent to members who have exceeded the annual allowance with that scheme. For most this is the time to resolve any unwanted annual allowance charges. Of course it may also be the case an individual has over contributed collectively via a number of schemes and they may not receive a statement but may still need to take action.

So it’s a great time to review contributions made and check whether scheme pays or voluntary scheme pays can be beneficial to your client’s circumstances.