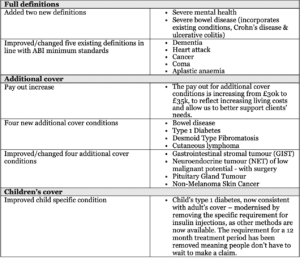

Royal London, the UK’s largest life, pensions and investment mutual, today announces it has widened the coverage on its critical illness cover by improving, changing and adding definitions to expand the scope for claims.

The mutual has reviewed its definitions and processes, and identified how conditions can be improved to deliver long term value for its customers.

This update is the latest in Royal London’s journey to improving the customer experience, and follows the announcement that the business had updated its pre-sale underwriting toolto widen the scope of medical conditions covered from 60 to over 3,600.

Jennifer Gilchrist, protection expert at Royal London, commented:

“As well as implementing ABI minimum standard changes, we have enhanced our critical illness cover by concentrating on cancer, severe mental health, type 1 diabetes, and bowel disease cover definitions. The changes have been driven by analysis of our claims experience and insight to maximise value and help deliver the best possible outcomes for customers.

“While we have made our definitions more precise, our aim is to provide improved clarity at the point of claim so we can enable quicker payments for customers at their point of need.”

As well as new and improved additional cover conditions, the pay out is also increasing from £30k to £35k, to reflect increasing living costs and to better support clients’ needs.

Alan Lakey, director at CIExpert, said:

“2023 has seen the demise of two major protection brands so it is heart-warming to see a major protection insurer affirm its commitment to the market by increasing both the quality and the amounts being paid out for critical illness claims. Additional payments for bowel disease and cutaneous lymphoma are both unique to Royal London and the improvements secure their position as a top-quality critical illness provider.”

Jennifer Gilchrist, continues:

“When it comes to critical illness cover, there’s been a fairly consistent pattern of claims being paid over a long period of time. We have added and changed definitions now as it’s important that cover continues to evolve to keep pace with medical science and concentrates on conditions where we can provide improved outcomes for customers now and in the future.”