A growing number of people with larger sums to invest is driving demand for bespoke investment management services, new research from Rathbones has revealed.

A study of financial advisers across the UK found that they expect the number of people with investable assets of more than £250,000 to grow over the next three years, rising from one in five (21%) to one in four (25%) of their clients.

Investable assets of £250,000 or more is generally the threshold for clients to be offered bespoke investment management services.

The research also found that more than half (52%) of those offered tailored support are aged between 50 and 55, while just 15% are under 50, highlighting the late stage at which many people approaching retirement are accessing personalised investment support.

Recent data from the Pensions and Lifetime Savings Association showed the cost of comfortable retirement passed £60,000 for the first time. The PLSA found that the amount of income needed for a comfortable retirement for a single person household is £43,900 while for a two-person household it is £60,600.

It estimates the two-person household would need a pension pot of between £300,000 and £460,000 while the single person household would need £540,000 to £800,000.

Simon Taylor, head of strategic partnerships at Rathbones, said: “There is increasing concern among many people in later life that, with the tax burden rising and the economy under pressure, they may not be able to afford the retirement they’d hoped for.

“Delivering the right support to people with many different assets and ambitions is complex and challenging, which is why a bespoke approach to investing helps advisers best protect and grow wealth so clients can enjoy their later years.”

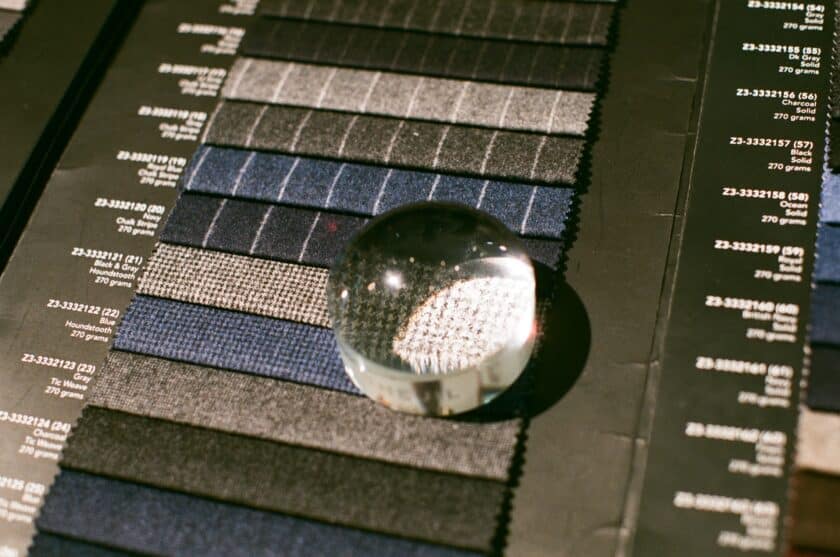

Main image: yasamine-june-Vxuk3rhzVxc-unsplash