Absolute return funds do not aim to shoot the lights out but should be consistently growing investors money, regardless of the underlying market conditions, says Luke Hyde-Smith, director, co-head of Multi-Asset Strategies, Waverton.

Absolute return funds seek to provide a positive nominal return for investors regardless of the underlying market conditions. There are around 600 absolute returns funds currently operating within the UCITS absolute return universe, with over $316bn under management. There is a range of funds under this umbrella, from pure absolute return funds to those that are more similar to multi-asset total return – with the risks and correlations varying accordingly.

A topic du jour…

Many investors are looking at alternatives, including absolute return, as they try to shelter from the uncertainty and volatility that has coloured the last six months. This is especially true given fixed income has not offered the protection that many investors have hoped, and the traditional 60:40 portfolio has, in performance terms, seen its worst start to a year in a decade.

In recent years, investors have benefited from a negative correlation between bonds and equities – most of the time bonds appreciated during the periods when equities were falling, providing cushioning, and leading to the success of the 60:40 portfolio. So far this year though the correlation has been positive, with both asset classes selling off. There is evidence to suggest that higher inflation is associated with a positive correlation and it may be that the coming years see less reliable protection from bonds, especially given that they are starting from such lofty valuations.

So why absolute return?

There are three primary characteristics of absolute return funds. Firstly, they seek to provide steady positive returns by incorporating exposure to a range of alternative assets. These can include specialist fixed income, such as short duration bonds or floating rate notes, it can use established strategies like equity long short or merger arbitrage, and there are structured opportunities including positive carry hedges and thematic notes. They can also hold a cash position which allows it to act swiftly when attractive investments arise.

Not only this, but they can also offer significant benefits for portfolio construction. Absolute return funds are often, if not uncorrelated, then at least correlated differently, meaning that they are a valuable source of diversification in a portfolio. With market conditions as uncertain as they are, spreading risk wider seems a wise move.

Thirdly, absolute return funds also aim to have low volatility, therefore dampening the fluctuations of portfolio. This is achieved primarily in two ways, firstly by buying assets with the requisite characteristics, and secondly by paying close attention to the correlation between the holdings.

Shedding the ‘absolutely no return’ moniker

The absolute return sector has been maligned for some time, and investors are especially wary following a few high-profile funds failing. However, given the variety of funds that are sometimes grouped into the absolute return camp, these are not representative of the whole. As is often the case, the headline does not give the full picture.

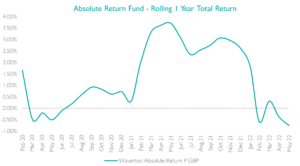

The Waverton Absolute Return Fund has delivered 3.7% since February 2019, a time when we restructured the strategy following the successful launch of the Real Assets Fund, outperforming the 1.4% return from the 3m GBP cash benchmark. This has been delivered with an annualised volatility of 2.4% and limited correlation or beta to broad asset classes. As the chart below highlights, out of the 28 discrete annual periods, rolling monthly, since the change in strategy, the fund has delivered a positive annual return 75% of the time, indicating the consistency in the return profile.

The Waverton Absolute Return Fund is one of the four building blocks of the Waverton Managed Portfolio Service and invests in a range of products that seek to make positive returns on a rolling twelve-month basis. The Fund does not seek to generate significant short-term gains, but rather to consistently grow money, regardless of the underlying market conditions.

Within the Fund, our systematic strategies, in managed futures and short-term trading have been performing well over 2022 year-to-date, while the increase in volatility across interest rate and FX markets has resulted in strong returns from our rate focused macro strategies. We have also seen strong performance from our ‘long value, short growth’ investments, both in absolute return strategies and structured dispersion opportunities profiting from diversions between growth and value stocks.

The Fund size is currently c. £160m and is available on 20 third-party platforms.