A significant chunk of property wealth released during the first half of the year came through remortgaging as customers benefited from increased flexibility and lower rates, according to new data from Key Later Life Finance.

The equity release adviser said 19% of all equity, more than £650 million, released in the six months to July came from customers switching to new plans. A total of 3,817 customers remortgaged during the period, compared to 2,130 in the same period of last year.

On average, customers chose to remortgage sums of £130,808 from 5% rates to 4.2%, which could save them up to £16,000 in interest over 10 years.

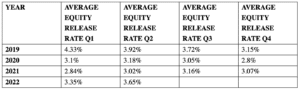

Key said growth in product flexibility, which saw customers choose from 676 products, had helped to drive the increase in remortgaging, in addition to historically low interest rates. While Bank of England base rate rises have pushed up the cost of equity release plans, the average rate taken out at the end of the first half of this year was 3.65% compared to 4.33% in the first quarter of 2019.

Will Hale, CEO of Key, said: “Remortgaging has also always been a core part of a specialist equity release adviser’s toolkit with advisers continuing to engage with customers throughout the life of their loan as a matter of course. Today’s figures highlight the benefits that customers can see from reviewing their equity release borrowing.

“House price increases have also contributed to the growth in this market with existing customers realising that remortgaging is not only about reducing rates but could also provide the opportunity to raise additional capital which is particularly relevant for some customers as the cost-of-living crisis hits finances.”

Hale added: “While arguably remortgaging may slow down as rates rise, the increasingly flexible nature of equity release products mean that this trend is likely to continue well into the future and become a feature of this market.”