Property price rises are pushing more estates into paying inheritance tax , with property constituting half the wealth of estates paying inheritance tax (IHT) in London, according to Just Group.

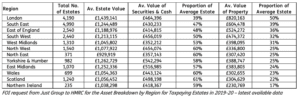

A Freedom of Information request from the retirement specialist showed that in 2019-20 property accounted for 50% of the wealth of estates in London paying IHT, with an average value of over £820,000. The average estate value in the capital was over £1.4 million, nearly £200,000 higher than the South East which was the region with the second highest average estate value.

The proportion of housing wealth in IHT-paying estates drops to 39% in the South East, 36% in the East of England and 32% in the South West. Just Group said cash and securities make up a larger proportion of estates in other regions, although substantially fewer estates are liable for IHT in these areas.

Stephen Lowe, group communications director at Just Group, said the rise in house prices across London and the South East was a key driver behind the data.

Lowe said: “The data was taken from the period up to the outbreak of Covid-19 and house prices rose significantly during the pandemic with homeowners over the age of 55 benefitting from £1 billion of property value growth every single day between March 2020 and June 2022. This is likely to have tipped many more estates over the IHT threshold, perhaps without the homeowner even realising.

“It is another reminder of why it is so important that people regularly assess the value of their estate, including an up-to-date valuation of their property.”

Asset breakdown of tax paying estates