Simon Moon and Alex Game, co-managers of the Unicorn UK Smaller Companies Fund, say they are bullish on the undervalued small cap sector and that it could lift considerably as inflation turns.

Simon Moon

Alex Game

Since the Brexit vote in 2016, UK equities, including the UK Smaller Companies sector, have been unloved and undervalued, say Moon and Game. This was exacerbated by the fall off in the markets in 2022.

But in consequence, it is providing the rare opportunity to find companies trading at notable discounts to their true value, a scenario which could see the small cap sector benefit once inflation turns, the managers add.

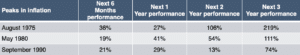

“If we look at historical data, we find that the turning point for small caps has been when inflation rolls over, such as in the 1970s and early 1990s (see table). In these situations smaller companies tend to recover better than the market,” says Game, who joined the fund in 2021 and became co-manager in January 2023.

Smaller Companies and inflation

Moon, who has managed the c.£40m fund since 2013, describes it as pursuing “a relative value approach”. This differentiates it from much of the rest of the sector which tend to target high growth momentum, he says. “We look long term, for quality companies that are profitable, cash generative but which are trading at an attractive value to their long term average, or against their peers.

“It’s not a value fund, it has inherent growth characteristics of investing into high value smaller companies but it’s not an out-an-out growth fund either.”

The growth and momentum style, which benefitted the small cap sector when interest rates were zero, suffered in 2022 and earlier this year when Silicon Valley Bank collapsed. The fund’s positioning meant it was able to better weather these periods.

Within the IA small cap sector there is a wide range of funds and fund styles, as the only criteria for inclusion in the sector is to invest in companies under a certain size. This means there are funds ranging from those invested in micro and nano-companies, through small to mid-cap and some funds holding quite large mid-cap companies.

Game says the Unicorn fund is a “purist small cap investor, focussed on genuine small cap businesses”.

The fund has outperformed both its benchmark Numis Smaller Companies plus AIM (ex IC) Index return and the IA UK Smaller Companies sector average over 1, 3, 5 and 10 years.

Both managers are invested in the fund – “it forms a meaningful proportion of our savings and pensions”, says Game, “which aligns us with our investors.” And both recently added more units of the fund to their investments, they say.

Portfolio example

Moon describes the small cap sector as “a really inefficient part of the market”, which with a purist approach, enables the managers to focus on finding the pricing opportunities that may not be obvious to other managers.

He flags Goodwin as an investment that typifies this approach. “It is a fascinating business, a true global market leader in niche industrial capital goods. For example, it manufactures the steel boxes that are used to contain the radioactive waste from Sellafield. It’s been around since the 1800s and is based in Stoke.

“Recently the company was offering a share buy back at a premium of 25%. In an efficient market you would expect the share price to rise by 25% as that is what the management of the company is pricing it at, by at least that amount. But the small cap market being inefficient, the share price only went up by around 10%. We bought more of the company and sold a large proportion of the shares back to the company at the premium.

“This is a stark case study of how inefficient the market is. And if you are in the position to do a small but consistent amount of homework, you can be in a much better position than the rest of the market to take advantage of those opportunities in very high quality companies.”

Game adds: “Part of the reason we are invested in small companies is the huge amount of pricing inefficiency which you can capitalise on. It gives you potential on the upside and protection on the downside, because there is fat between the market price and what you think the valuation is of these businesses.”

Currently, the fund has 44 holdings and a self-imposed cap of 50, to ensure there is no style drift. “If we want to add something to the portfolio then we need to look at what we hold and whether there is a name on the list that should be exited in favour of the holding we want to bring in. We find that’s a really good discipline to have,” Game says.

Bullish

The managers say they are bullish on the market going forward. “This is the cheapest I’ve seen the market in many years,” says Moon.

“Often there is a catalyst which you can look back on and say that is when things started to change. Recently, Deutsche Bank bought the specialist corporate brokerage Numis, a deal which is a statement of intent and a positive move for the UK market. That could be the catalyst event.”

As the reporting season has developed, nearly all the fund’s companies have “met or exceeded expectations”, Moon says. “More than we would expect to do so in a normal, standard reporting season. This gives us enormous re-assurance that companies are meeting the challenge of inflation and that the underlying demand is still there.”

Game adds: “We’re stockpickers in stockpickers market. We’re positive on pockets of the market and we’re going to where the high value good quality companies are. We like to get to know companies extremely well, we like to find the price anomalies. Currently, 80% of the fund is trading at 20% plus discount to its long term average. That’s 20% reversion to value without companies needing to do very much at all. That gives us a lot of comfort going forward.”

Simon Moon is also co-manager of the Unicorn UK Income strategy alongside Fraser Mackersie.

Alex Game joined Unicorn in 2014 and became co- manager of the Unicorn UK Growth Fund in January 2021 alongside Fraser Mackersie.

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. The managers’ views are their own and do not constitute financial advice.

[Main image: nicholas-cappello-Wb63zqJ5gnE-unsplash]