Katherine Harvey, client services director, Russell Gibson had a novel means of winning her role at interview, particularly as it didn’t exist at the time, she tells Rob Kingsbury

Katherine Harvey went for an interview at Russell Gibson as a senior paraplanner and walked out as clientservices director for the company, a role that didn’t exist at the time. She did it, she says, by pitching the role in the context of a suitability report.

“It was a bold move and I admit, a little bit cheesy,” she says. “I had done research on the company and spoken in depth to the owners and wanted to show them what I could do for them, in addition to my paraplanning skills. At interview, the owners asked me questions about all aspects of my career and skill set that no-one else had ever asked me, which piqued my interest and made me realise that they had the ability to think differently.

“I presented the report with myself as the investment and the firm as the client and explained where I thought I could best fit into their vision for expansion. Innovators by nature, the business owners had the foresight to take me on and allow me to run with it, which was a leap of faith on their part but one that has thankfully paid off for them and me.”

Before you all rush to rewrite your CVs in the same vein, much of Katherine’s career to that point had been in business development roles, both within financial services and including researching, developing and successfully attracting third-party investment into her own business.

She began her working career in the early 1990s, working for nearly five years as constituency secretary for the Rt Hon Malcolm Rifkind QC MP. “It was such a great first job that people have asked me if I got it through nepotism but actually I had responded to an advert in the Edinburgh Job Centre. I was exposed to so many different things and I learned so much working for him, not least that you can treat people the same no matter who they are and what they do.”

Leaving the role to undertake a business degree at Edinburgh Napier University, when she graduated she joined Scottish Widows, first liaising with an assigned panel of financial advisers by telephone – a new role the company populated with graduates to help the in-the-field salesforce and which is still going today, Katherine explains. She then became a service development consultant, primarily identifying and implementing business process improvements within the Client Service Division areas and managing relationships with Scottish Widows sales teams and the key IFA accounts assigned to them.

Becoming a mother led her to write the business plan and get the backing for her own business, Mummy’s Kitchen Ltd, an online organic baby food business, which she left Scottish Widows to pursue.

“It was a situation where I couldn’t find commercially what I was making for my child in my own kitchen. It took a lot of research, planning and negotiation, particularly around the regulatory and organic sides of the business, which was accredited by The Soil Association.”

Unfortunately, for a premium product, the launch timing was completely wrong, coming immediately before the Financial Crisis. Despite the extensive research predicting otherwise, there simply wasn’t the demand to sustain the business, and also experiencing a marriage break up, she returned to her native Aberdeen.

She first took a career break to focus on being a mum and then found a part-time role as the office manager for a firm of solicitors, which gave her time to decide on where next to take her career. Having spent several years in financial services during which time she gained relevant qualifications, she decided to pursue a career in financial planning but eschewed sales support for a paraplanning role.

She spent the next four years working as a paraplanner for a small IFA firm, Medical & Dental Financial Planners Ltd until it was acquired, pending retirement of the adviser owner, by The Financial Planning Group, owners of Acumen Financial Planning.

“I enjoyed my time in the Acumen fold and was offered a great opportunity, to take over in the adviser role at M&DFP but I wasn’t sure that the advice route was right for me,” Katherine says. “So, I explored other options and the more I learned from Russell Gibson about their plans for the company and the scope for progression, the more I felt the move into my current senior management role was right for me.”

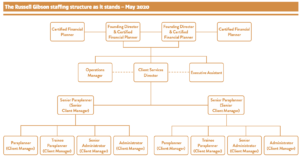

Structural change

What she found at Russell Gibson was a relatively small company but with the intent and ambition to grow. “They had already identified through the business improvement initiative Concord that they needed more support, including more paraplanners, in order to grow but some restructuring on-the-ground, in terms of procedures and processes was also required to properly support the plans. I was able to come in with a fresh pair of eyes and see what changes could be made so everyone was in the right job, and the business was getting the best out of everybody.”

This, she explains, meant tracking processes from pre client meeting through to post meeting work, looking at how the back-office worked and supported the front office, identifying some workflow blockages and duplication and assessing where the processes could be finessed to run more efficiently. Recruiting of paraplanners and administrators was also key. “In the past year we have almost doubled the client service team.”

It also meant analysing the role of the paraplanner in the company, identifying how the technical tasks should be tackled, and by whom – “a lot of the technical work was sitting with the financial planners and that wasn’t the best use of their time” – and bringing in more people with the requisite skills sets to effect that change and allow the advisers to concentrate on the strategies and client-facing work.

Currently, as Client Services Director, Katherine heads up the client service team, which includes the paraplanners and the admin teams. These are split into two ‘pods’, each with a senior paraplanner, additional paraplanners and administrators, both serving two advisers.

When she joined the company, there was no defined structure within the team as it was small, she says. “What I wanted to do was build in structure, so there are now two senior paraplanners overseeing the day-to-day workflow. Also, we wanted to build a route for progression within the firm, as well as recruiting into paraplanner positions from administrator roles, so people can see there is room to progress within the company, even if they don’t want to pursue a career in advice.”

Katherine admits that she was nervous about the level of change being implemented, especially as it meant bringing in new recruits. “It has been a challenging year with lots of changes and I fully expected there would be some friction or resistance. I have been very, very fortunate that people have adapted extremely well to the changes. I think everyone knew they were necessary and have embraced them accordingly. It really is testament to what a strong team the firm has built up over the years.”

Paraplanners as professionals

Another important part of the way Russell Gibson is structured is ensuring clients see the firm’s paraplanners as “professional individuals in their own right”, Katherine says.

With this in mind, it is the paraplanners who make first contact with clients to arrange annual review meetings, collect the necessary details and data from them, and do the follow up correspondence. The intention is that they will eventually do this for referrals and new clients too and be heavily involved in the onboarding process.

As such, paraplanners will be first port of call for client questions. “They will deal with any non-advice questions and pass the others on to the adviser to follow up on.”

The intention is that paraplanners will attend all client meetings with the advisers – it has not fully happened to date Katherine explains, as they have been recruiting to the right capacity – “ironically just as were reaching that and the paraplanners were gearing up to start attending even more meetings, lockdown occurred.”

To further solidify this professionalism with clients, all paraplanners have business cards and their qualification certificates sit alongside those of the advisers in the client meeting rooms.

“It’s about showing clients we are a team of professionals and everyone in the firm that they are valued, from having a route for career progression to involvement in the client relationships.”

The practical element of having a paraplanner in the meeting also means the data capture is enhanced, in comparison to when the adviser has to deliver the meeting and take notes along the way.

“The planner can focus on discussion and delivering the strategy to the client, in the knowledge that absolutely everything is being captured by the paraplanner. Also, the client is meeting the paraplanner face-to-face and the paraplanner is hearing first-hand what the client is saying and what their goals and objectives are, which means no debrief is required and this also assists the paraplanner when drafting recommendations.”

Aims and ambitions

While the past year has been focused on restructuring, recruitment and improving processes and workflows, Katherine says when the firm returns to business proper, post lockdown, it will be set to take forward its growth plans, through a variety of strategies.

Based in Aberdeen, a lot of the firm’s clients are involved in the oil and gas industries. “It is a very different clientele and type of work to my previous role at Medical & Dental Financial Planners. Our clients often are contractors, so tax is a big issue, especially the constantly changing landscape around issues like IR35. We have a sister company, Lime Blue Accountancy, with which we work closely on these types of issues.

“It is frustrating that when the Coronavirus crisis took hold we were on the cusp of taking our plans forward. But when things return to normal, we will be set to gear up and continue the push for growth through new business. We’ll start promoting through PR, marketing and events and ramping up our visibility. To keep growing is our intention – and we’re getting there.”