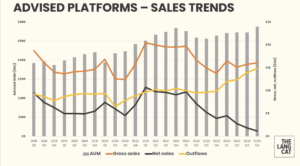

More money was taken out of platforms in 2023 than in any other year, the latest report from the lang cat shows.

Outflows hit record highs each quarter, with outflows of £53.18bn for 2023 as a whole, up over a third on 2022’s total (£39.01bn).

Despite the overall negative picture, advised platform assets and gross sales did show signs of improvement in the final quarter of 2023. Assets under management for advised platforms (21 in total) increased by 5.34% in the final three months of the year to total £575.14bn, recovering the lost ground from volatility since Q4 2021 (£567.93bn).

The optimism from falls in inflation and hope that a peak in interest rate increases may have been reached, saw new flows onto platforms, with gross advised sales figures of £16.06bn up 16.57% on Q4 2022.

Rich Mayor, senior analyst at the lang cat, said: “The last quarter of 2023 rounds off the dominant theme of rising outflows hammering net sales in the advised platform market.

“Gross sales have been steady throughout, but the wider economic conditions mean more money has been taken out of platforms in 2023 than in any other year, with ISAs and pensions bearing the brunt of it.

“We’ve tracked the reasons for the increase in outflows with advisers in both qualitative and quantitative exercises throughout the year, but our largest exercise for State of the Advice Nation was in field during Q4 too.

“The results show that the cost-of-living crisis meant financial plans had to be adjusted for a good portion of clients. The main reasons cited were investors supporting themselves and family members with the increase in household expenses, followed by concerns over capital preservation in volatile markets.

“On the latter point, we’ve also noted a shift in advisers’ retirement income strategies, with an increase in the use of annuities for more risk-averse clients.”