The Pensions Dashboards Programme has published a data standards guide, providing the basic definitions that pension providers and pensions administrators need to follow in order to deliver pensions information to the Pensions Dashboard when launched, including estimated retirement income.

Following the Programme’s Progress Report published in October 2020, the guide, covers the data for finding and viewing information about any pensions that individuals have not yet accessed. This includes:

- Individuals’ uncrystallised pensions for all UK pensions (ie those pensions that have not been through a benefit crystallisation event)

- Defined contribution (DC) pensions, which have had one or more uncrystallised funds pension lump sums withdrawn, the balance of the DC pension.

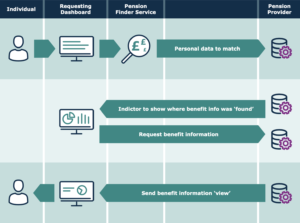

Once the individual’s identity has been assured by the identity service, the individual’s verified identity and any additional data they may have provided as part of the process, is passed to all pension providers by the pension finder service.

The pension providers then attempt to match pension records they hold against the individual’s identity.

Each pension provider has to determine the matching rules they wish to apply, based on their knowledge of the data they hold. This will include minimising the risk of returning the wrong person’s data.

The information that pension providers will be expected to supply to the initial dashboards will include:

- Details of the pension arrangement in which the individual has a pension

- Details of the organisation administering the pension arrangement

- Where applicable, the employment that gave rise to the pension

- An estimate of the annual income the individual might receive in retirement, ie the estimated retirement income

- Where applicable, the accrued pension amount

- Signposts to additional information about the pension.

Chris Curry, principal of the Pensions Dashboards Programme, said there was a lack of uniformity in how providers and schemes currently supply ERI information, which he described as “problematic”, as it made it difficult for users to compare differing presentations and determine ultimately, what their pensions information means.

Chris Curry, principal of the Pensions Dashboards Programme, said there was a lack of uniformity in how providers and schemes currently supply ERI information, which he described as “problematic”, as it made it difficult for users to compare differing presentations and determine ultimately, what their pensions information means.

“Our approach for initial dashboards is to display the ERI as currently reported in the best possible way, recognising the challenges that this will present to the user.

“We will also continue to work with industry to agree and implement a consistent way of providing and displaying a comparable ERI.

“In the long term, as technology advances and the service matures, it may be possible to revisit what dashboards can do and allow them to perform calculations to display ERI.”

He said the guide did not cover the State Pension, which would be dealt with separately.

Commenting on the guide, Nigel Peaple, director of Policy & Research, Pensions and Lifetime Savings Association, said: “The data standards outlined in today’s publications seek to achieve the Government’s commitment to deliver initial dashboards that offer ‘find and view’ functionality. Crucially, these standards will enable savers to understand their estimated retirement income (ERI) more easily than ever before, though some serious challenges remain to ensure that ERI values are consistent across DB and DC entitlements.

“Whilst pension schemes can now start to prepare their data in earnest, it is essential that the PDP turns its focus to the development of a robust consumer protection framework over the course of 2021. Appropriate protections should be in place long before the first dashboard goes live to ensure that the data dashboards present and the functionality they offer do not result in consumer detriment, mis-selling or pension scams.”

However, Duncan Watson, CEO of pension administrator EQ Paymaster, said that the publication “should set alarm bells ringing” for schemes in respect of the work required ahead of 2023, when the Dashboard is expected to go live.

He commented: “The data elements published today are a wake-up call for pension schemes refusing to take their future data obligations seriously or delaying their preparations for the dashboard. At a bare minimum, schemes need to make sure that all the pensions they are responsible for are automatically accessible, personal data items are wholly accurate and accrued pension entitlement value is available on every single record.

“These data standards should act as further warning that pension schemes need to change how they operate now in order to be Dashboard-ready by 2023. Schemes should know enough now to already be discussing with their administrator how dashboards are going to fit into their data strategy.

“The dashboard should not be seen as a one-off project for schemes to achieve a bare minimum tick in a box. It should prompt a fundamental change in attitude to how they treat data all of the time which has long been neglected by many in the industry. The bar for data quality is set to rise.

“Schemes should be proactive in their engagement and not wait to be dragged kicking and screaming towards implementing these data standards that will benefit millions of pension savers in the UK.”

The Pensions Dashboards Programme has produced a short (1m 30s) video about data standards requirements.