Latest quarterly pension transfer ceding times data published by Origo show that across the 28 providers participating in the Fintech’s Transfer Index, performance has improved over the past six months.

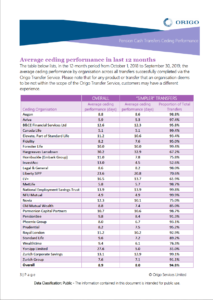

The third publication of the Origo Transfer Index, which tracks the transfer performance of some of the leading providers in the pensions market, showed a decrease in the overall average pension ceding time from 9.3 calendar days for the year to 31 March 2019, to 8.9 calendar days for the year to 30 September 2019.

Currently 28 firms are committed to publishing their data on a quarterly basis via the Origo Transfer Index, with others in the pipeline the FinTech says. Origo currently has over 100 brands signed to its Transfer Service but the 28 firms who have agreed voluntarily to the publication of their data in the Index make up 80% of the transfer volumes.

Anthony Rafferty, managing director, Origo (pictured), said: “Through the Origo Transfer Index, we are looking to further improve both the speed, security and the transparency of the transfer process. By publishing the times taken to transfer out of a pension, Origo and its community of administrators, master trusts, platforms and providers are encouraging other organisations to commit to greater transfer transparency and so create a benchmark for the industry as a whole to aim for.

“We encourage other organisations to participate in the Index, thereby helping to improve outcomes for individuals.”

The quarterly statistics are displayed below and also can be downloaded at: www.origo.com/oti

Origo also reported that transfers through its Transfer Service have passed 4 million since launch in 2008. In the 12 months to 30 September 2019, 730,305 transfers were completed a 26.5% rise in transfer volumes on 2018.

Rafferty added that this constituted “a terrific milestone in the history of the service. This is a reflection of its quality, the growing community of organisations using the service and the trust in which it is held by the industry.”

He said the continuing increases are primarily due to a general rise of transfer volumes across the Origo Transfer Service community, alongside new companies, such as NEST, signing up to the Transfer Service in the past 12 months.

The table above shows the average overall performance time for each ceding provider, then the average performance time for the “simpler” transfers which are completely under their control. It also shows what percentage of the overall the latter makes up, and this will vary depending on the product mix of that provider. For example, a specialist SIPP provider would likely have more transfers affected by disinvestment delays, and would therefore likely have less “simpler” transfers.

Simpler transfers are those where the ceding provider has complete control over, and can reasonably be held fully accountable for, the entire ceding process. They are not necessarily simple in nature, but they are not complicated by external factors.

By way of contrast, with some transfers the provider must wait for third parties (e.g. waiting for approval from trustees, or waiting for investment managers to disinvest funds) before they can complete the transfer. Alternatively, steps may need to be undertaken to protect consumer interest, such as protection of safeguarded benefits. There may also be regulatory requirements, such as

• the provision of Risk Warnings; or

• where Financial Advisers have to complete an Advice Certificate; or

• where awaiting documentation from Trustees for Occupational schemes.

The “Overall” statistics include performance on ALL completed transfers whether fully under the control of the ceding provider or not.