Continuing our new series of articles highlighting quick wins when using adviser firm technology, software experts share quick tips and tricks to help make your working day more efficient, Sian Gulliver of Iress how you can achieve a better client and partner policy data search in Xplan.

Funds under management (FUM) or Assets Under Management (AUM) are essential equations for any financial services business.

They not only reveal the total market value of all of the financial assets a firm looks after on behalf of their clients (or business), but they are also often used to estimate fee calculations, servicing considerations or to understand the worth of a firm and where they sit in the market against their competitors.

Reporting on FUM is dependent upon the scenario and what data needs to be filtered, whether it’s by adviser, segment, service category, fund manager, provider and so on.

FUM report options in Xplan

There are a few different ways that you can obtain FUM information, through the Dashboard, at a clients portfolio level, through Management Reports and also Xport.

Firstly, you need to make sure your Xplan, processes and datafeeds are set up in the right way to ensure the holdings on the site are marked whether they are under management or not. To do this, each holding must be set to Under Management = Yes. Xplan can be set up so that this is ‘Yes’ by default within System Settings if required.

Now you’re ready to run your reports.

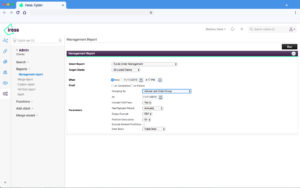

Management Report

There is a standard Management Report for FUM with all manner of available groupings available so you can see useful totals like Client Group, Datafeed Vendor and more.

To obtain this, locate the client base on which you want to run the report such as a full list of clients or a sub set. Go to the Management Reports area and locate the Funds Under Management report option listed under the Portfolio category. There are other FUM reports available which are worth a look too.

Once you choose the report, there are some key filters you can choose such as grouping, inclusion of portfolio fees and the date at which you require the FUM and also you can choose to output to PDF or to CSV allowing you more flexibility on analysing your FUM data.

Portfolio

At client level, you can tick the FUM Only box under Filter Options to filter the FUM for that client. You can easily see for that client if there is any difference in the two values.

You may also see the FUM Only filter in other Portfolio areas such as Portfolio Positions within the Portfolios menu.

If you’d like more client data alongside the FUM data, you can use Xport to provide this for you using the data sources of Portfolios (child of Client) and Subfunds (child of Portfolio).

Search for FUM – A simple Xport on our Community to find out more. Or search the Iress Community for other useful articles or help with FUM scenarios.