Are your clients planning a withdrawal from their pension early in the new tax year? Be ready with your tax code to avoid falling foul of the emergency rate, says Dan Bosiacki, Technical Consultant at AJ Bell

The pension freedom rules introduced on 6 April 2015 brought increased flexibility over the frequency, timing and quantum for many pensioners accessing their retirement savings. Whilst the rules put the emphasis on optionality versus the one-size-fits-all approach of capped drawdown, there is a recurring blind spot that will need to be considered as part of the planning process.

For clients who prefer to withdraw a single lump sum instead of staggering their pension payments throughout the tax year, there may be emergency tax, or over-taxation, to contend with. This can be particularly frustrating for those who prioritise their tax planning, ensuring they stay within their personal allowance or within the basic or higher rate tax bands when choosing how much to take.

So, how does this work?

Where the pension provider holds a P45 form for the member from the current tax year, usually because they have stopped working, they will be able to deduct the correct amount of tax from any withdrawals as they are made. Similarly, where the provider holds a cumulative tax code from previous withdrawals from the scheme they will have what they need to prevent any nasty surprises.

However, where the provider does not hold this information, they are required to deduct tax at a temporary rate, known as the emergency rate. The amount being withdrawn is treated as a monthly payment despite the intention in many cases being to take a one-off lump sum – hence the name ‘Month 1’.

In practical terms the provider will apply 1/12 of the personal allowance, £12,570 for 2021/22 through until 2025/26, to the payment, assessing the remainder against 1/12 of the income tax bands currently in force.

This leaves clients with potentially large shortfalls in the amounts they receive which can be particularly problematic where the aim was to withdraw just enough to cover all budgeted expenses and commitments.

Example

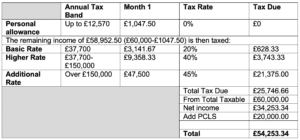

In the below example a fund of £80,000 has been crystallised. £20,000 has been paid as a PCLS and the member is making a one-off income withdrawal of £60,000. The amount they receive under the emergency tax code is £54,253, with the tax calculation below:

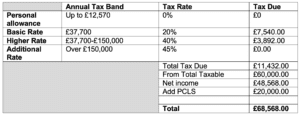

Compare this with the expected tax treatment of 12 equal monthly income payments assuming the same circumstances:

On a fund value of £80,000 the difference between the emergency tax calculation and the correct tax calculation is over £14,000 which is clearly significant.

That is the bad news. The good news is there are options available to reclaim any overpayments, even for those taking one-off income withdrawals where HMRC can’t simply adjust the following payments as they would for somebody receiving regular income.

One option is to wait until the end of the tax year for HMRC to reconcile the client’s account, typically upon submission of a Self-Assessment Tax Return.

Those looking for a quicker reclaim can do so by completing one of the three HMRC forms and submitting this with their P45. The form the client should complete depends on their personal circumstances:

- P50Z – the pension scheme has been fully encashed and the member and has no other source of income during the tax year

- P53Z – the member has fully encashed their pension pot and has another income

- P55 – the member has partially encashed their pension and does not intend to make any further withdrawals

This route is typically suited to those with larger overpayments and can result in a quicker resolution, providing everything is submitted correctly.

Indeed, the latest HMRC figures show that, since April 2015, £835 million has been refunded to those who felt the force of an emergency tax bill upon taking their first flexible withdrawal of the year. Just in the final quarter of 2021 alone, over £42 million was refunded, with the average reimbursement coming in at £3,107.

If neither of those options are particularly enticing, one planning ‘hack’ is to take a small nominal payment at the very beginning of the tax year, £100 for example. This will be subject to emergency tax as described above but will prompt HMRC to issue the correct tax code to the pension provider. The intended pension payment can then be requested and importantly, taxed correctly, leaving your client with the amount they’re expecting and no nasty surprises.