Advice firms have a problem choosing between Managed Portfolio Services, as the market is looking increasingly homogenous, with little to differentiate the offerings of investment management firms , argues Peter Stewart, associate director, Waverton Investment Management.

Managed Portfolio Services (MPS) have grown hugely in popularity over the last 10 years as advisers sought a discretionary portfolio solution that was cost effective and efficient for a broad range of clients. This growth has been supported by various tailwinds – and looks set to continue with the introduction of the Consumer Duty.

This requirement for greater transparency, accountability and, most importantly ‘fair value’ have ushered in a paradigm shift from the use of ‘bespoke portfolios’ to MPS and multi-asset funds. Clearly, there remains a necessity or preference for bespoke portfolio solutions where clients have individual requirements such as specific levels of income, or have existing assets with large capital gains liabilities that they do not wish to realise. However, this is not the case for a large number of clients and, as a result, their requirements may not justify the higher fees associated with ’bespoke’ offerings.

Alongside this transfer of assets from bespoke to MPS, advisers who have typically built their own portfolios using third-party funds are becoming overwhelmed by the additional due diligence requirements of being a manufacturer. This has provided further demand for MPS solutions.

However, for advisers engaging with a DFM’s MPS for the first time, or for firms reviewing their panel of providers, the market is looking increasingly homogenous, with little to differentiate the offerings of investment management firms. While service (for the adviser and the client), risk-mapping and platform availability remain important factors in the selection process, the convergence of asset allocations and third-party fund selection has made it a tricky market to navigate.

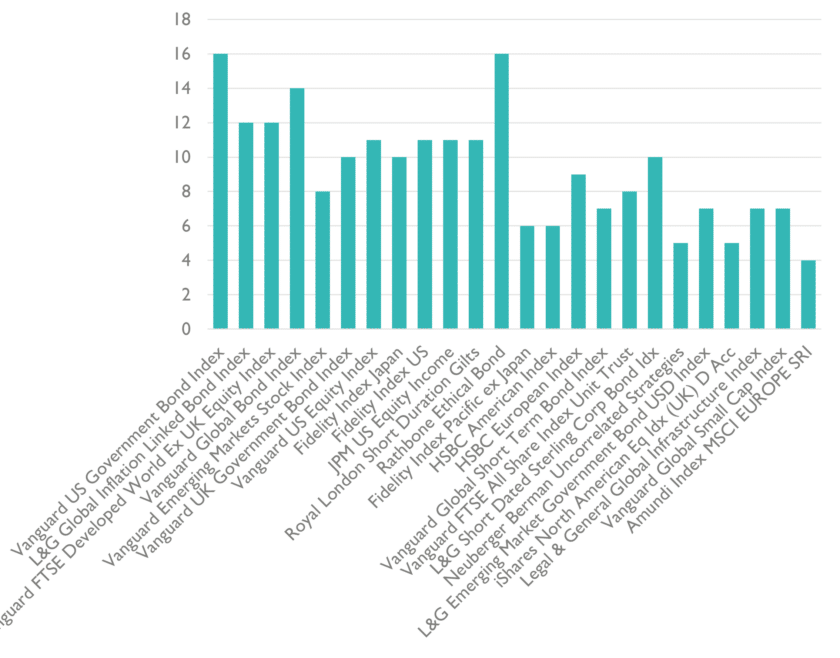

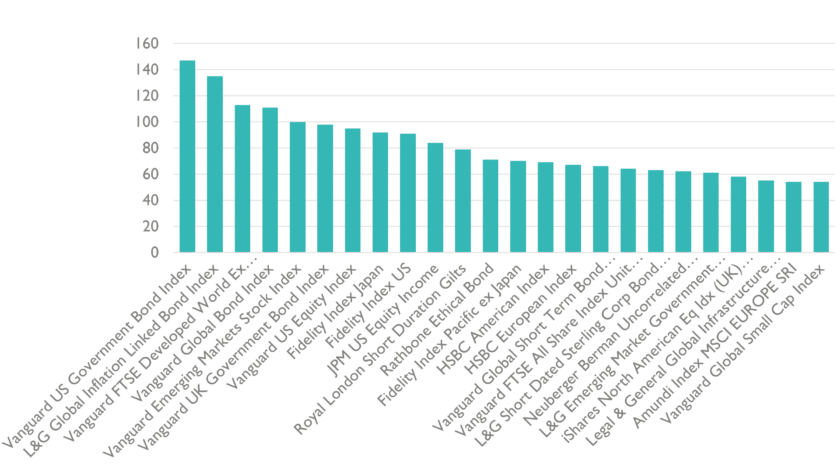

This convergence has been accelerated by cost pressure, as many active managers have sought to reduce costs by moving equity exposure into passive vehicles. As shown in Figure 1 and 2, the same holdings are found across many MPS portfolios. In turn, typical balanced portfolios across providers will have very similar asset allocations and geographic exposure, therefore, even blending two or more providers will not add much in terms of diversification.

Number of MPS providers with similar holdings

Number of portfolios with similar holdings

Since Waverton was founded in 1986, we have been active investors, across global markets and across a broad range of asset classes. Our MPS portfolios are constructed of four Waverton building block funds, enabling us to invest directly for our clients rather than relying on third-party fund managers or index tracking providers. This gives consistency across platforms (and in our direct custody), full clarity on what we own (and importantly what we choose not to own), what the known risks are and a reasonable understanding of how our portfolios would perform given a specific set of circumstances.

This building block structure also facilitates our exposure to alternatives and in particular, real assets. Portfolios of funds are more limited in their ability to own investment trusts, removing a potential source of diversification and return.

In conclusion, at Waverton we have taken a distinct approach to MPS portfolio construction, which can be valuable for clients who may desire greater transparency or knowledge of their holdings, or for advisers who may wish to supplement their panel or seek a genuinely active solution to blend with a passive manager, safe in the knowledge that this blend will result in additional diversification.

Risk warnings: The opinions expressed are based on current market conditions and are subject to change. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

For further information on Waverton MPS please contact [email protected]