As we enter our eighth week in lockdown, AJ Bell has reviewed the markets, dividends and best performing funds over the past 50 days.

Following the severe downturn across global indices in early March as markets reacted to news of the growing pandemic, there has been some positive news for investors, according to the investment group.

All the major markets have risen since lockdown began on 23 March. The smallest UK companies showed the biggest rebound, with the FTSE AIM All Share increasing by 37% during the period, while the FTSE 250 rose by 25% and the FTSE 100 climbed 19%. Across the FTSE 100 index, just six blue chips saw their share price fall during the past 50 days, while in the FTSE 350 25 companies delivered an investment loss.

In the US, the S&P recorded a 31% rise in the lockdown period, despite mortality rates continuing to climb. Asian markets also rose, with Hong Kong’s Hang Seng increasing by 12%, and China’s SSE Composite rising by 9%.

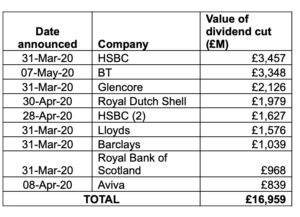

However, investors reliant upon dividends fared less well, with a total of 289 dividends cut or deferred during lockdown, totalling £28.3 billion of payments. The halt on dividends included 41 FTSE 100 companies, prompting equity income managers to predict cuts to pay-outs from funds hitting 40% of more, with limited options left for income-seekers. See table 1 below.

The big banks announced the largest cuts, with HSBC axing £5 billion in dividends, while Lloyds announced a £1.6 billion dividend cut and Barclays £1 billion.

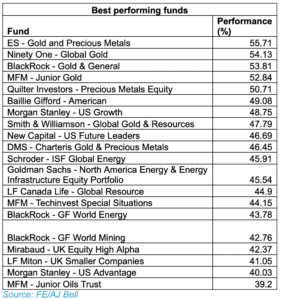

Best performing funds

Meanwhile, funds saw a polarised performance during lockdown, although 98% of funds made money for investors during the period.

Laura Suter, personal finance analyst, AJ Bell, said: “Gold funds topped the best performers during the period with ES Gold and Precious Metals delivering the highest return of 55.7%, as investors look to turn to gold in times of trouble, pushing up prices. [See table 2.]

“Technology funds have been another standout as the crisis has seen how technology has become integral to our everyday lives. US-funds have also been among the top risers, fuelled in part by this technology boom but also by the sharp rebound in American markets after falls in February and early March.”

In contrast, property funds fared less well, with the property market grinding to a halt during lockdown making it difficult to accurately price the asset. However, the worst performer in the lockdown period was Neil Woodford’s former fund, now called LF Equity Income, which lost 16.7%.

AJ Bell said its own data showed a trend among investors to look for bargains, with three-quarters of the deals completed on AJ Bell Youinvest being purchase of assets, compared to just a quarter being investors selling.

Suter added: “For stock hunters, airlines and travel companies were popular, with investors hoping to profit from previous falls in the stocks before the lockdown and hoping the outlook for these companies wouldn’t be as dire as many predicted. Oil giants featured for similar reasons, but investors will have been dealt a blow by Shell’s scrapping of its dividend at the end of April.”

Table 1: Largest dividend cuts during lockdown

Table 2: Best performing funds during lockdown