The vast majority of UK adults do not have a lasting power of attorney, with registrations remaining below pre-pandemic levels.

Research from Canada Life found four out of five adults (78%) in the UK do not have a registered lasting power of attorney, including 77% of over-55s.

Andrew Tully, technical director at Canada Life, said: “Lasting power of attorneys put in place a valuable safety net and can provide reassurance at hugely difficult times. The very low uptake in registering LPAs, especially among the over 55 age group, is likely because of the lack of awareness of what they are and the resulting benefits of having them.”

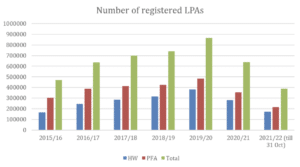

A recent freedom of information request from Canada Life showed that the number of LPAs registrations fell by 26.5% to 636,628 in the 2020/21 tax year, compared to the previous year, reversing a trend which saw huge increases in the previous five years.

Separate research from Quilter found that despite a drop in registrations, just half (50.6%) of people were confident they would not require long term nursing care during their lifetime.

Quilter said its own research had found fewer than one in three (29%) well-off baby boomers have registered a LPA, despite a report from Age UK predicting that the number of individuals with complex care needs will rise in the next 20 years as life expectancy increases.

The investment platform has called on the government to help raise awareness of the importance of registering an LPA before it is too late.

Shaun Moore, tax and financial planning expert at Quilter, commented: “Putting an LPA in place is a vital part of financial planning and often one of the first things a financial adviser will recommend for a client, yet the number of LPAs registered for those approaching later life remains worryingly low.

“Last year, we were pleased to see the government launch a consultation on modernising LPAs. The process must be streamlined so we can remove any barriers to registration. The government is set to share its response to the consultation imminently, but in the meantime, government must continue to increase awareness of the benefits of LPAs and support people to set one up sooner rather than later.”

Moore added: “Some people believe that setting up an LPA will leave them vulnerable and choose not to set one up, but this is not the case. Additionally, many people only associate having an LPA with older people and therefore believe they do not need to think about it yet, but this is the very reason they should have one in place. An LPA can provide clients and their families with the peace of mind that their wishes will still be carried out should they lose the capacity to do so themselves.”