Retirees waiting until later life to buy annuities are at most risk of missing out on extra lifetime income by failing to shop around, says Just Group.

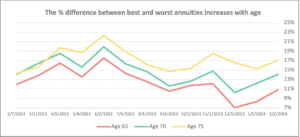

Analysis carried out by the retirement specialist found that the gap between the best and worst deals is much higher at age 75 than at age 65 or 70.

A healthy 75 year old can secure about 17% more income from the best annuity provider compared to the worst. The gap sits at 14% at age 70 and 11% at age 65. Despite this, figures published last year by the Financial Conduct Authority found half of annuity buyers did not compare deals and 52% did not know disclosing poor health could result in higher rates.

Stephen Lowe, group communications director at Just Group, said: “Improving returns have pushed up demand for annuities in recent months but buyers must do their homework to avoid the poor value providers and to secure the highest income possible.”

In cash terms, a healthy 75-year old buying an annuity with a £50,000 pension could expect about £4,661 income each year for the rest of their life from the most competitive provider compared to £3,980 from the least competitive – a difference of £681 or 17% more income every year.

At age 70, the best-worst difference is £492 or 14% extra income a year, while at age 65 the difference is £342.

Lowe continued: “Annuities provide secure income so people have peace of mind knowing that they can spend what they receive without worrying if it will fluctuate or disappear during their lifetime. But there are no second chances when you buy an annuity, you must get it right the first time. That means disclosing health and lifestyle information so that the rate offered is personalised to your circumstances.”