In our regular series, the Fund calibre research team analyse a specific sector or asset class.

Passive funds have been gaining popularity for a number of years – particularly in the past decade, as the retail distribution review brought costs into sharp focus.

While we’re not anti-passive (we use the odd US large cap index fund and silver mining ETF in our managed portfolios) anyone who regularly reads our columns will know we are pro active. Especially good active. But justifying slightly higher fees to clients can be hard.

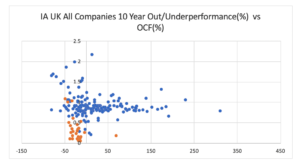

This scatter chart helps. It looks at all the funds in the IA UK All Companies sector. The y-axis shows OCF, the x-axis shows performance vs the IA UK All Companies sector average – after fees have been deducted. The blue dots are active the orange are passive.

It shows quite clearly that cheap does not equal best. Just one index fund – it’s the HSBC FTSE 250 Index – outperforms over 10 years. But even then, 7 out of 9 actively managed mid cap funds do better. Indeed, a bias towards mid-caps has helped many of the outperformers. But again that is an active decision – indexes cannot change their bias.

At the other end of the scale, the chart also shows that OCFs over 1.25% detract from performance. So paying a bit more – but not excessively so – can pay off overtime. The good news is, the pressure on costs is such that active is getting cheaper – and therefore better value. Therefore the next ten years should be even better for relative performance too.

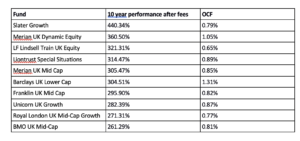

And if you are wondering about the detail of the top ten, wonder no more:

Data sourced from FE Fundinfo, total returns in sterling over ten years to 7 January 2019