When Momentum Investments SA undertook a fund switching study looking at investor behaviour, it found some interesting general trends and four clear investor types, says Paul Nixon, head of Behavioural Finance, Momentum Investments SA.

Risk tolerance, if measured correctly, only needs to be measured once (in general). Willingness to take risk or risk tolerance is linked to our personality (Weber and Milliman 1997; Douglas and Wildavsky 1982). Personality theory has been shown to be a good predictor of financial behaviour as well (Van Raaij 2016).

So, we embarked on a study[1] to identify patterns of investment behaviour in discretionary unit trusts on the Momentum Wealth platform, in a bid to say whether a person’s personality traits can affect their investment decisions.

Using unsupervised machine learning clustering algorithms, we were able to identify switching behaviour patterns over an extensive time period (2006 – 2021) from 35,000 investors performing over 130,000 investment switches. This exercise was replicated for in 2020 and 2021 to get a better understanding of behaviour during the COVID-19 global pandemic.

Our approach is based on an assessment of both how past investment returns are related with fund switches and how investment performance may be linked to investors deciding to take on a greater or lesser degree of investment risk. We take the level of switches into account as well as the extent to which their decision reflects a desire to chase the past performance of other funds. As shown in Nixon et al. (2019) this can lead to a significant ‘behavioural tax’ being imposed on their investment returns.

Fund switching trends

While not all switches were made into a fund that had outperformed the one the investor was in, it was these switches that most interested us. We found a clear inflection point in behaviour around the 12.5% return mark: if the returns were below 12.5%, and especially when returns were negative, we deemed that the switching decision was driven by fear – and these formed the majority of switching decisions. If an investor was already receiving a return of 12.5% or above, and switched to a better performing fund, then we deemed these decisions to be driven by greed. Investors were 9x more likely to perform an investment switch when returns dipped below the 12.5% mark.

Finally, we looked at investors who, for reasons of their own, consistently switched into a worse-performing fund than the one they were in. This is usually indicative of behaviour in market turbulence (switching to safer assets like cash that usually underperform equities).

Investor types

Based on scores allocated to investors according to how often they switched, whether they did so out of “fear” or “greed”, and whether they switched into a lower- or higher-risk fund, we were able to cluster investors into four groups.

- The avoiders

- The market timers

- The Anxious investors

- The Assertive

Behaviour tax in 2021

The term “behaviour tax” refers to the negative impact an investor’s behaviour has on his or her investment outcome.

Behaviour tax is calculated as the difference in future performance between the funds switched from (the theoretical buy-and-hold portfolio) and the funds switch to. ‘Future performance’ is calculated from the end of the month a switch was made up to end of September 2021 (the last month of analysis for 2021).

The future performance was annualised to make calculations comparable for switches made in different months. Overall, the value lost over the period of analysis was over £4.5 million which equated to an annualised behavioural tax of 3.5%. This was lower than the record-level behaviour tax of 6.5% in 2020.

Breaking down the behavioural tax incurred per archetype

As expected, the Market Timers were the most active archetype during the period of analysis. Even though they made up the smallest portion of active investors, they made the most switch transactions. Market Timers realised the largest behaviour tax with an average of 5% per year of the switch amount lost.

Assertive investors realised the second largest average behaviour tax at 4.09% of the switched amount lost. Assertive investors regularly chase past investment performance. As the market recovery started to stabilise during February 2021 a continued ‘greed’ factor of chasing past performance would have incurred a significant behaviour tax (10.9% of switched amount lost) for the average Assertive investor.

For Anxious investors, the fear factor resulted in an average behaviour tax of 3% of the amount switched. By de-risking and switching to lower performing funds these investors realised a lower return than they would have had if they kept to a buy-and-hold strategy.

Lastly, the Avoiders incurred the lowest behaviour tax by avoiding the market volatility as far as possible. However, it is important to consider that while Avoiders are the least active of the archetypes, they are more prone to a different kind of behaviour tax that originates in not being exposed to risky markets enough over the long term.

Conclusion

When reviewing the past performance of the funds switched from in 2020 to the funds switched to in 2021, it is clear that more often than not past performance does not translate to future returns.

Ultimately, this contributed to over £4.5 million in value destroyed by investors that equated to a 3.5% annualised behaviour tax. The 2021 period penalised investors that switched the most and the behavioural archetype that represents this behaviour is the Market Timer. Where the Anxious investor paid the most in behaviour tax during the COVID-19 crash, the market recovery and subsequent market volatility penalised those that switched the most. Market Timers paid just over 5% in behaviour tax for 2021.

Once again, the low levels of engagement from the Avoider archetype paid off as they paid by far the lowest behaviour tax at just over 1%. Whether or not the elevated levels of both savings and general engagement in portfolios are part of a new trend is yet to be seen.

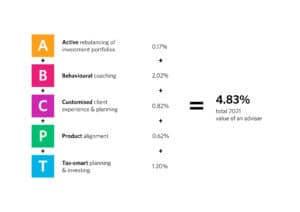

Financial planners should look no further than Russell Investment’s[2] formula that stipulates that helping your clients avoid behavioural mistakes in the face of volatility generates the client an excess return of 2%.

Momentum Investments SA is most certainly aiming to use nudging techniques to communicate with the different segments with the right message at the right time to deliver better client outcomes and to help advisers generate the behavioural alpha of over 2% that the Russell Investments study demonstrates. This is the next level in making investments truly personal.

[1] momentum-behaviour-matters-report-december-2021.pdf

[2] 2021 Value of an Advisor Study (russellinvestments.com)

[Main image:alyssia-wilson-vPicKH-ouX0-unsplash]