James Chu, head of Investment Solutions, Tricio, looks at the advantages of using goal-based asset allocation to construct an income portfolio

After a torrid 2020, we all hope 2021 will be different and better. But one thing we do not expect to change a lot are interest rates in the UK which are expected to remain at historical lows. In Tricio’s previous article in Professional Paraplanner*, our Chief Economist John Calverley reminded us that inflation may pick up in the next 12 to 24 months. The combined low interest rate and high future inflation environment makes construction of income portfolios more difficult, even for a modest level of net yield (after fees) of 4-5% pa. It is particularly challenging because many investors in such portfolios need income for their retirement and cannot afford to take excessive investment risk.

At Tricio, we adopt a special approach for UK income investors who invest in tax wrappers like a stock and shares individual savings account (ISA), or in self-invested personal pensions (SIPP).[1] This is to put together the portfolio using goal-based asset allocation.

Income investors have different goals

The first step of any portfolio construction is to identify investor needs. On the surface, there is just one goal for any income-seeking investor: getting regular income that meets their financial needs. The simple approach is to pick investments and securities that can be combined to give the right yield and risk, ideally optimised to be “efficient” as per model portfolio theory.

But if one thinks carefully, there are other sub-objectives that need to be met. For example, for investors who are drawing down their pension, their portfolios need to be constructed to deal with the impact of market movements and the timing of the drawdown. This requirement is not needed for those income investors who still have other sources of income like salaries and are still saving.

Goal-based framework

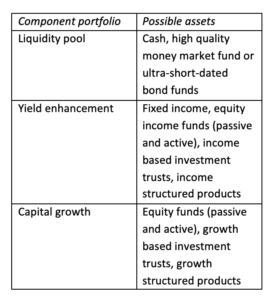

This means that the income portfolio must also meet several sub-goals to get the right outcome. To do this, you need different sub-portfolios that each will meet different goals:

- You need a liquidity pool with no market risk which investors can draw down with certainty in the short term – this is particularly important for investors who are drawing down their pension and need certainty of income that is not affected by market movements.

- You need part of the portfolio that can produce enhanced yield to replenish the liquidity pool regularly after investors’ drawdown.

- You need another part of the portfolio to build up some capital growth, ideally beating inflation. The capital growth can be reinvested to the yield enhancement portfolio to sustain future income and cashflows.

For both 2 and 3, one can vary the level of risk in these parts of the portfolio to match the overall risk profile of the client. In addition, there could be a need to control path dependence of the portfolio for clients who are drawing down income. Both of these may rely on use of alternative asset classes that have lower correlation with traditional equities and bonds, and ideally with some market risk control mechanism built in (e.g. structured products or alternative investment trusts).

Applying goal-based allocation

To apply the above goal-based asset allocation framework, we construct component portfolios that meet each of the above sub-goals. The component portfolios are then combined to form the final portfolio. The table below provides an example.

The allocation of each component portfolio is optimised such that the expected return and volatility of the overall portfolio meets the client’s investment objectives and risk profile. It is also stress tested quantitatively to find out how long the income can be sustained under different market distress scenarios, and the time it takes for the yield enhancement and capital growth component portfolios to recover. Further fine tuning and adjustment will then be carried out to make sure the overall portfolio is robust enough.

Advantages

There are at least two advantages in using goal-based asset allocation to construct an income portfolio.

First, as each component portfolio is designed to meet a sub-goal, it is easier to explain to the end investor how the portfolio is put together and the factors that have been affecting the portfolio performance. For example, investors can be reassured that despite some short-term market corrections, their income can still be sustained because we have set aside a liquidity pool. We can then refocus the clients on the longer-term return potential of the yield enhancement and capital growth portfolios when markets recover.

Secondly, it is easier to manage the investment to meet the changing needs of the end investors due to life events and other issues. One will simply change the allocation to each component portfolio, or to add another component. This flexibility is invaluable for advisers and wealth managers.

Goal-based asset allocation or portfolio construction has become more widely used by wealth managers around the world. The author used this framework previously in private banks and investment firms. These organisations benefited from this approach, as advisers and paraplanners can work more effectively in building better trust with clients. This in turn helps investors to focus on their long-term investment goals, rather than worrying too much about the impact of market performance on their income needs.

* See Viewpoint, December 2020 issue

Author’s Note: [1] The discussion in this article works in these tax wrappers because any drawdown for the cashflow is not subject to different tax treatments (income vs capital gains). The general principles still apply if drawdowns must be based on income, though the component portfolios would be different.

This article was first published in the February issue of Professional Paraplanner.